Chapter 8: Mortgages, Derivatives, and Leverage

It is impossible to fully understand how the deregulation of our financial system and the failure to enforce existing regulations led to the financial crisis that began in 2007 without looking at the way in which financial deregulation affected the markets for mortgages and in which financial derivatives increased leverage within the economic system leading up to the Crash of 2008.

The Mortgage Market

Before 1938, home mortgages were highly illiquid assets, the reason being it is very difficult for a third party to judge the quality of a mortgage. When a bank originates a mortgage it has a very good idea of the creditworthiness of the borrower, the quality of the real estate that is the collateral for the mortgage, and the characteristics of the neighborhood in which the real estate is located. The further one gets from the bank that originated the mortgage the less one knows about these things. As a result, the secondary market for mortgages—that is, the market in which existing mortgages are bought and sold—tended to be very local which made it difficult for people in smaller communities to obtain mortgages for the purpose of purchasing homes.

In 1938 the Federal National Mortgage Association (Fannie Mae) was created as a government agency to facilitate home ownership by providing a secondary market for government insured mortgages. In 1968 Fannie Mae was privatized as a Government Sponsored Enterprise (GSE), and in 1970 the Federal Home Loan Mortgage Corporation (Freddie Mac) was chartered as a GSE to provide a secondary market for non-government insured mortgages, and Fannie Mae’s mission was changed to provide a market for non-government insured mortgages as well. In the meantime the Government National Mortgage Association (Ginnie Mae) was created as a government agency to replace Fannie Mae in the market for federally insured mortgages. Ginnie Mae is a government owned corporation within the Department of Housing and Urban Development (HUD), whereas Fannie Mae and Freddie Mac are private corporations that were created by the government and then sold to the private sector.

The GSEs and Ginnie Mae worked closely with mortgage originators, mostly banks and thrifts (i.e., savings banks and savings and loan associations), to maintain and improve underwriting standards (i.e., the standards by which loans are made) and were very successful in providing a nationwide secondary mortgage market by purchasing mortgages that met their underwriting requirements from the mortgage originators. This, in turn, greatly facilitated home ownership throughout the country.

Mortgage-Backed Securities

Originally, the GSEs financed their operations by selling uncollateralized bonds in the capital market to obtain the funds necessary to purchase mortgages from their originators, but in the 1970s the GSEs began securitizing the mortgages they purchased by placing pools of mortgages in trusts and issuing bonds collateralized by the revenues generated from the pooled mortgages. The GSEs guaranteed the mortgages that collateralized the bonds they issued, and these bonds are referred to as agency Mortgage-Backed Securities or agency MBSs.

In the 1980s, private companies—mostly investment banks, depository institutions, and mortgage banks—began securitizing mortgages by sponsoring SPVs and selling mortgages to the SPVs they sponsored. The bonds issued by the SPVs of private companies are referred to as private-label Mortgage-Backed Securities or private-label MBSs. Private securitizers did not guarantee the mortgages they sold to their SPVs, and, as a result, private securitizers had to offer credit enhancements to minimize the interest rates they would have to pay on the MBSs their SPVs issued.

One method of credit enhancement was to over collateralize the MBSs they issued so that the face value of the MBSs a private-label SPV issued was below the face value of the mortgages held as collateral for their MBSs. A second method was to provide an excess spread on the rate of interest received from the mortgages over the rate of interest paid on the MBSs so the amount of money taken in from the mortgages that collateralized their MBSs exceeded the amount the SPV was obligated to pay to bondholders. The most important of these enhancements, however, was subordination whereby the MBSs issued by the privately sponsored SPVs were structured in a hierarchy of tranches (a French word meaning slices) such that private-label MBSs in a lower tranche were subordinate to those in a higher tranche.

The way subordination works is that the MBSs issued by the SPV are broken down into senior tranches which have first claim to the income received from the mortgages held by the SPV, junior tranches (also called mezzanine tranches) which have a claim to this income only after the MBSs in the senior tranches have been paid, and equity tranches (also called residual tranches) which are paid only after the MBSs in the senior and junior tranches have been paid. This structure gives the MBSs in the senior and junior tranches protection against default on the mortgages held by the SPV in that the defaults on the underlying mortgages must be greater than the income owed to the equity tranches before the income and principal payments available to service senior and junior tranches will be affected. It gives even more protection to the MBSs in the senior trances in that the defaults on the underlying mortgages must be greater than the income owed to both the equity and junior tranches before the income available to service the senior tranches will be affected.

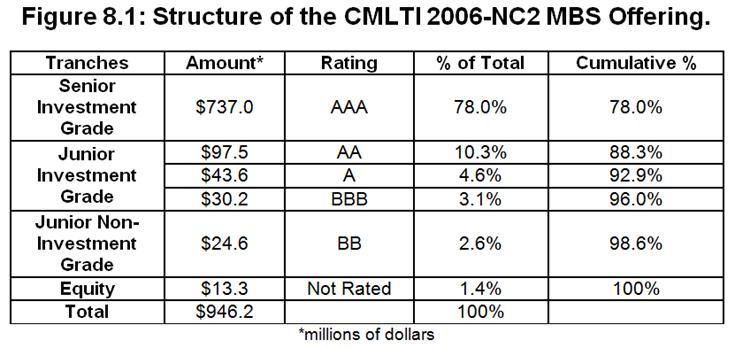

The way in which MBSs are structured is illustrated in Figure 8.1 which shows the structure of the CMLTI 206-NC2 offering sponsored by Citigroup in 2006.

Source: Financial Crisis Inquire Report, Security Exchange Commission.

This offering was backed by 4,499 mortgages with a principal value of $947 million, and was described as a “typical deal” in the final report of the Financial Crisis Inquire Commission. As is shown in this figure, 78% of the MBSs in this offering were investment grade securities in the Senior Investment Grade tranche that were rated AAA by the rating agency Standard & Poor’s. Another 18% were in the Junior Investment Grade tranches that were rated BBB or above, but less than AAA, which brought the total of the investment grade securities in this offering to 96%. The 2.4% of the offering in the Junior Non-Investment Grade tranches that received a BB rating or below held a junk bond status, and the Equity tranches made up 1.4% of the offering.[44]

By structuring their offerings in this way, the sponsors of private-label Mortgage-Backed Securities were able to compete with the GSEs even though the sponsors of the private-label MBSs did not guarantee the mortgages that backed their MBSs. As a result, private-label MBSs began to increase their share of the Mortgage-Backed Securities market dramatically in the 2000s, but there was a catch: Virtually all of the demand was for the highest rated securities in the offerings, and there was relatively little demand for those that were lower rated. (FCIC Smith) This led to a problem.

For securitization to work, all of the tranches in an offering must be sold. Otherwise there’s not enough money to purchase the collateral needed to make the offering viable. When the lower rated securities can’t be sold elsewhere, the sponsor of the offering is forced to purchase them. This limits the ability of the sponsoring institution to sponsor new offerings since its purchases from its previous offerings must be financed. The ability to finance these purchases is limited by capital requirements in the case of a regulated institution such as an investment bank or depository institution,[45] or by margin requirements in the case of an unregulated institution such as a hedge fund. When the sponsoring institutions reach their funding limits, they can no longer sponsor new MBS offerings. To solve this problem the sponsors of Mortgage-Backed Securities turned to alchemy. (Dowd)

Collateralized Debt Obligations

Collateralized Debt Obligations (CDOs) are created in the same way Mortgage-Backed Securities are created and are divided into subordinate tranches with the equity and junior tranches being paid only after the senior tranches are paid, and the equity tranches being paid only after the senior and junior tranches are paid just as MBSs are structured. In addition, CDO offerings were rated similarly by the rating agencies with 95% or so of the offering rated investment grade (BBB or higher) and as much as 80% of the offering investment-grade tranches (the Senior Investment Grade tranches) receiving a triple-A rating.

The fundamental difference between Collateralized Debt Obligations and Mortgage-Backed Securities is in the nature of the collateral. While MBSs are backed only by mortgages, CDOs use a variety of debt obligations for collateral—bonds, loans, and other Asset-backed Securities (ABSs)—rather than a single kind of financial instrument. (FCIC)

Until the 2000s, CDOs were a relatively obscure financial product confined to a relatively small market, but in the early 2000s the CDO market simply exploded. From 2003 to 2006 it increased more than seven fold as it went from $30 billion to $225 billion in just three years. In the process, CDOs transformed the mortgage market by increasing the demand for MBSs in the lower rated tranches. In 2004, CDOs were the dominate buyer of BBB-rated MBSs, and in 2005 they purchased virtually all of the BBB tranches of these securities. Between 2003 and 2007 over $4 trillion Mortgage-Backed Securities were created and some $700 billion of CDOs that contained lower rated tranches of MBSs as collateral were created as well. (FCIC)

The alchemy involved in this process should be apparent. By taking the lower rated MBSs and using them as collateral for CDOs, the sponsors of the SPVs that offered these CDOs for sale were able to convert as much as 80% of the BBB or BB rated MBSs held as collateral in their SPVs into triple-A rated securities in the form of AAA rated CDOs. They were, indeed, able to make a silk purse out of a sow’s ear—or so it seemed—and the alchemy didn’t end there. CDOs were often structured with the lower rated tranches of other CDOs as part of their collateral. CDOs with 80% or more of their collateral in the form of lower rated tranches of other CDOs were referred to as CDOs squared, and by this sleight of hand the sponsors of the SPVs were able to convert more than 60% of the lower rated CDO tranches held in their portfolio of collateral into triple-A rated CDOs squared. (FCIC)

Collateralized Debt Obligations fueled the mortgage market as it expanded in the mid 2000s in that CDOs allowed the sponsors of MBSs to keep the lower rated tranches of the MBSs that they couldn’t sell otherwise off their books. This freed up capital and, thus, allowed them to expand the creation of MBSs beyond what they would have been able to if the CDO market had not existed.

Derivatives and Leverage

Leverage is a term used to describe methods by which investors can enhance their return on their equity. The most common form of leverage is the kind discussed in Chapter 5 and Chapter 7, namely, borrowing money to increase the amount to invest. This kind of leverage is referred to as balance sheet or debt leverage where the amount of leverage is measured by the debt to equity ratio—that is, by the value of the amount borrowed by the investor divided by the value of the equity (net worth) of the investor. There is another kind of leverage that can be used to increase the return on equity, namely, that which is obtained through the use of derivatives. Derivatives are contracts that derive their value from some underlying asset or collection of assets. They are used either to provide a hedge against a potential loss or to speculate on future events.

Option Contracts

Perhaps, the simplest derivative to understand is an option contract. An option is a financial instrument that gives the holder of the option the right, but not an obligation, to either buy or sell (depending on the kind of option), an asset at a specified price during a specified period of time. An option to buy an asset is a call option. An option to sell an asset is a put option. While an option does not obligate the holder of the option in any way, if the holder of the option chooses to exercise the option during the specified time period the writer of the option is obligated to sell, in the case of a call option, or to buy, in the case of a put option, the asset being optioned at the specified price.

For example, if you purchase a 30-day option to buy 100 shares of IBM stock at $100/share—a 30-day call option for 100 shares of IBM stock at $100/share—this gives you the right to buy 100 shares of IBM stock for $100/share at any time during the next 30 days. At the same time, it obligates the writer of the option to sell 100 shares of IBM stock to you at $100/share at any time you choose during the next 30 days.

If you purchase a 30-day option to sell 100 shares of IBM stock for $100/share at any time during the next 30 days—a 30-day put option for 100 shares of IBM stock at $100/share—this gives you the right to sell 100 shares of IBM stock at $100/share at any time during the next 30 days. At the same time, it obligates the writer of the option to buy 100 shares of IBM stock from you at $100/share at any time you choose during the next 30 days.

If you own 100 shares of IBM stock that is worth $100/share today you can use an option as a hedge against the risk of the value of your stock falling over the next six months by purchasing a 6-month put option that gives you the right to sell 100 shares of IBM stock at $100/share at any time during the next six months. Having purchased such an option, if the price of IBM stock should fall to, say, $50/share you would be protected from that loss. Your $5,000 loss in the value of your stock would be offset by the $5,000 gain in the value of your option that gives you the right to sell your 100 shares of IBM stock for $100/share. Your only loss would be the price you had to pay for the option.

You can also use options to speculate on the price of IBM stock even if you don’t own the stock. Suppose you believe that IBM stock is going to double in value over the next six months. You can take advantage of this expectation either by purchasing IBM stock directly or by purchasing a 6-month call option for IBM stock. If the price of IBM stock is $100/share it will cost you $10,000 to purchase 100 shares of stock. If you purchase the stock and are right about the price of IBM doubling over the next six months, the price of your stock will increase to $200/share. Your 100 shares of IBM stock will then be worth $20,000, and you will make a $10,000 profit.

Alternatively, if the price of a 6-month call option to buy IBM stock for $100/share is $10/share, that same $10,000 you have to invest could be used to purchase an option that would give you the right to buy 1,000 shares of IBM stock for $100/share. If the price of IBM stock were to double, the value of your option would increase from the $10,000 that you paid for it to $100,000 since your option gives you the right to buy $200,000 worth of IBM stock for just $100,000. As a result, you would be able to make a $90,000 profit ($200,000 - $100,000 -$10,000) by investing your $10,000 in the option as opposed to a $10,000 profit by investing in the stock. Thus, purchasing the option allows you to leverage your $10,000 investment by increasing your profit 9 times what you would be able to make by buying the stock directly.

Just as debt leverage increases your risk of loss as it increases your potential profit, the same is true for derivative leverage. Even though your potential loss is limited to $10,000 whichever investment you chose to make in the above example, if you chose to invest in an option you will lose the entire $10,000 if the price of IBM stock fails to increase above $100. You will not lose your entire $10,000 investment if you chose to purchase IBM stock directly unless the price of IBM stock goes to zero.

Futures Contracts

Historically, derivatives in the form of futures contracts—an agreement to buy or sell something at a specific date and price in the future—have been around for over a hundred and fifty years where the difference between a futures contract and an option contract is that both parties are obligated to perform on a futures contract. The buyer agrees to buy, and the seller agrees to sell. Neither the buyer nor the seller has the option of not buying or not selling.

Just as with options contracts, futures contracts can be used to hedge against a potential loss or to speculate on changes in prices. To see how a futures contract can be used to hedge against a potential loss, consider the plight of a farmer who knows approximately what it will cost to plant a particular crop in the spring and how much product he will have available to sell when it is harvested in the fall, but has no way of knowing what the price of that crop will be when he brings it to market. If he plants the wrong crop he will lose money if the price at harvest time is below his costs of production. One way he can hedge against this possibility is by entering into a contract in the spring with a miller to sell his crop in the fall at an agreed upon price. By entering into this kind of contract both the farmer and the miller are able to protect themselves against adverse changes in prices when crops are brought to market in the fall.[46]

As was noted, futures contracts can also be used to speculate on changes in prices. If the price of wheat is $2/bu. in May and you think it will be $4/bu. in the September you can take advantage of this situation by buying wheat today, storing it until September, and then selling it at whatever the price turns out to be. If your expectation is correct and the price in September is $4/bu. you will be able to make a profit of $2/bu. on each bushel of wheat you purchased and stored, less the cost of storing the wheat from June to September. If it costs you $1/bu. to store the wheat your net profit will be $1/bu.

Now suppose that you can enter into a futures contract to purchase wheat at $3/bu. in September, a price that is equal to the price of wheat today plus the cost of storing wheat that exists today until September. If you enter into this contract and your expectation is correct and the price in September is $4/bu. you will make the same profit of $1/bu. when you purchase the wheat in September at $3/bu. and resell it at $4/bu., less, of course, the cost of the commission to the broker who arranged the contract. There are, however, a number of important differences.

To begin with, when you purchase a futures contract you don't have to actually buy any wheat in order to make a profit. As the price of wheat approaches $4/bu. in September, the value of your contract will approach $1/bu. since that is the profit you can make on it when it comes due. As a result, when your contract comes due in September you will be able to sell your contract to someone who actually wants to buy wheat or to someone who has contracted to sell wheat and wants to close out his or her contract to sell by buying an offsetting contract to buy without having to actually come up with the wheat needed to fulfill his or her contract to sell. This makes speculating through futures contracts much less time consuming and less of a bother than actually purchasing and storing the commodity involved.

Second, it you wish to purchase, say, 10,000 bushels of wheat to speculate on the price of wheat you will have to come up with $20,000 to purchase the wheat and an additional $10,000 to store the wheat until September for a total of $30,000. If the price of wheat is $2/bu. in May and you can purchase a futures contract to purchase 10,000 bushels of wheat at $3/bu. (or less) in September (the price in May plus the cost of storing the wheat until September) there is no reason for you to actually purchase the wheat since you will make at least as much profit or more if you purchase the futures contract that commits you to purchase the wheat in September for $3/bu. as you will if you purchase the wheat at $2/bu. in May and store it until September.

In addition, you will have to come up with much less cash to purchase the futures contract than you will have to come up with to purchase the wheat. When you purchase a futures contract you only have to come up with the commission paid to the broker and enough collateral to convince the counterparty to your contract that you will, in fact, be able to live up to your end of the contract. The collateral posted on a futures contract is referred to as the margin, and it can be as little as 10% or even as low as 5% of the value of the wheat covered by the contract. That means that instead of having to come up with $30,000 to purchase and store 10,000 bushels of wheat you can place the same bet on the price of wheat in September by coming up with only $3,000 (ignoring the broker's commission which I will do from now on to simplify the exposition) if the margin is 10% or only $1,500 if the margin is 5%.

Just as with option contracts, futures contracts allow you to leverage your equity. If you have $30,000 to invest in this speculative endeavor you have the option of using that $30,000 to purchase 10,000 bushels of wheat and storing it, or at a 10% margin you can use your $30,000 as collateral for 10 futures contracts that commit you to purchase 10,000 bushels of wheat each. If you are right and the price of wheat is $4/bu. in September you will make a $10,000 profit on the 10,000 bushels of wheat you purchased with your $30,000 if you chose the first option, and you will make a $100,000 profit on the 100,000 bushels of wheat you have committed yourself to purchase with your $30,000 if you chose the second option. In other words, you can leverage your investment tenfold by purchasing the futures contracts at a 10% margin. If the margin is 5% you can leverage your investment twentyfold by purchasing 20 contracts that commit you to purchase 200,000 bushels of wheat.

Futures contracts not only leverage your equity, they leverage your risk as well. If you purchase the wheat in the above example, and the price falls to $1/bu. instead of increasing to $4/bu. as you had expected, you will lose the $10,000 you spent on storage and an additional $10,000 when you are stuck with 10,000 bushels of wheat you bought at $2/bu. that can now only be sold at $1/bu. This 67% loss on your investment may sound grim, but if you had instead purchased 10 futures contracts on a 10% margin that committed you to purchase 100,000 bushels of wheat at $3/bu. and you can only sell that wheat for $1/bu. on its due date you are out $200,000. That's a 667% loss on your investment. If you had purchased 20 contracts on a 5% margin your loss would be $400,000 on your $30,000 investment. That's more than 13 times the amount you had planned to invest in the first place![47]

This brings us to a very important point: When derivatives are used to hedge against a risk of potential loss the risk that is hedged is transferred from one party of the derivative contract to the other. There is no increase in risk in the system as a whole, and there even may be a reduction in risk in the system as a whole if the risk is transferred from an individual or institution that is less able to cope with the potential loss to an individual or institution that is better able to cope with the potential loss. As a result, using derivatives to hedge against a potential loss can have the effect of increasing the stability of the economic system as a whole. This is not the case when derivatives are used for pure speculation.

When derivatives are used for pure speculation where neither party is hedging against a risk of potential loss, both parties to the contract assume risk that they otherwise would not have assumed. There is no transfer of risk, and the total risk of potential loss in the system increases. The fact that speculators add to the liquidity of the market and thereby enhance the ability of other participants to hedge does not negate the fact that pure speculation increases the risk in the system as a whole and, as a result, reduces the stability of the system as a whole.

While in theory, pure speculation is a zero-sum game where the losses of one party are equal to the gains by another and all that occurs is a transfer of wealth from one group of individuals to another, in practice this is not necessarily the case and often is, in fact, not the case. This theory ignores the possibility of default on the part of those who speculate and the damage that can be done to those who are directly and indirectly affected by the speculative bubbles that are created as a result of speculation. When speculative bubbles burst, the inability of those affected to meet their contractual obligations can have a cascading effect that can bring the entire economic system to its knees. The history of this being so goes back at least 800 years. (Kindleberger MacKay Graeber) The recognition of this problem led to the establishment of exchanges and clearinghouses. These are institutions that are designed to minimize the risk of default and also to minimize the risks of manipulation and fraud within the market.

Exchanges and Clearinghouses

The markets for options and futures contracts have become highly efficient as these contracts have been standardized and are widely traded on exchanges where an exchange is simply a central meeting place where trading takes place. The importance of an exchange is that it provides a place where trading is in the open, and all of the participants in the market can see the quantities bought and sold and the prices at which trades are made. This kind of openness, or what is referred to as transparency in the market, is designed to minimize fraud and the ability of traders to manipulate prices.

In addition, the risk of default on derivative contracts has been minimized through the establishment of clearinghouses whereby the contracts agreed upon between individuals at the exchange are cleared through a separate corporation where that corporation—the clearinghouse—becomes the counterparty to the buyers and sellers in the contracts that are agreed upon in the exchange. The way in which the risk of default is minimized for those derivatives that are traded through an exchange with a clearinghouse can be seen by examining the way in which a futures contract comes into being.

If you wish to enter into a contract to buy (or sell) wheat or some other commodity at some point in the future you go to your broker and place an order. Your broker submits your order to the exchange where all of the offers to buy and sell are submitted by the brokers that are members of that exchange. The brokers’ traders on the floor of the exchange match the offers to buy with the offers to sell in the future where the prices at which the commodities are to be bought and sold are determined through an auction process among the traders. The contracts that have been agreed upon are submitted to the clearinghouse at the end of each trading day to be cleared, and the cash transactions between the brokers and the clearinghouse are settled. The outstanding contracts held by each broker's clients are then revalued in accordance with the prices set during the day, and each broker is required pay to the clearinghouse any balance his or her clients may have accumulated in order to maintain the margin required on their contracts as a result of the day’s trading. Once the trades of the day have been reconciled, and the margin requirements have been met by the members of the exchange, the contracts between the clients of the brokers are dissolved, and the clearinghouse becomes the counterparty to both sides of each of the contracts the clients have entered into. Your broker then delivers to you your contract with the clearinghouse that you sought to enter into.

The efficiency of this system arises from the fact that all of the participants in the market are policed by the brokers, by the exchange, by the clearinghouse, and the entire process is regulated by the government. All transactions are executed publicly on the floor of the exchange, available for all to see, and changes in the values of the outstanding contracts are reconciled each day in order to maintain the collateral each broker must deposit with the clearinghouse as determined by the margin requirement on the contracts his or her clients have with the clearinghouse. You are legally responsible to your broker to perform on your contract and your broker is legally responsible for your performance to the clearinghouse as well. That means that if you default on your contract your broker is responsible to make that contract good to the clearinghouse, and if your broker defaults to the clearinghouse, the clearinghouse is on the hook to make that contract good to whomever originally made it with you. That protects your original counterparty from default on your part, and it also protects you from default on the part of your original counterparty since your counterparty’s broker is responsible for the contract his client made with you as is the clearinghouse.

The only situation in which your contract will not be honored is if the clearinghouse were to default. This is clearly a possibility, but the fact that 1) the changes in the values of all outstanding contracts between brokers and the clearinghouse must be reconciled each day, 2) each broker is required to maintain the margin on his or her clients’ contracts with the clearinghouse as the values of his or her clients’ contracts fluctuate each day, 3) the brokers’ clients are required to maintain the margin on their contracts with their brokers as the value of the contracts fluctuate each day, and 4) the fact that the behavior of all of the participants in the market is strictly regulated and supervised by the government minimizes this possibility.

Credit Default Swaps and Synthetic CDOs

Even though derivatives have been around for a very long time, the way in which they have been used has changed dramatically over the past forty years. Prior to the 1970s, futures contracts were used for commodities, and options contracts in commodities had been outlawed since 1936. In the 1970s futures contracts for financial assets were introduced, and the ban on option trading in commodities was lifted in 1981. Option trading was subsequently extended to include financial assets and foreign exchange as well as commodities, and new kinds of options and futures contracts were created—contracts based on indices of commodity and financial asset prices as opposed to those based on individual commodities and individual financial assets.

At the same time, much of the trading in derivatives moved from an exchange/clearinghouse environment to the over-the-counter market where contracts are not standardized and are made directly between individuals or institutions without the protection of a clearinghouse, with very little government regulation, and with very little, if any, transparency. In addition, an entirely new category of derivative came into being: the swap, whereby contracts were devised that allowed income streams generated by assets to be exchanged in domestic as well as in foreign currencies,[48] and in 1997 the Credit Default Swap was born.

Credit Default Swaps

A Credit Default Swap (CDS) is a kind of insurance contract wherein the seller of a CDS agrees to compensate the buyer against the consequence of an adverse credit event such as the issuer of a bond defaulting on its interest or principal payment. The buyer pays the seller a quarterly or biannual premium for the protection provided by the seller where the protection generally consists of an agreed upon, lump-sum payment from the seller to the buyer should the adverse credit event (e.g., default) occur.

The market for Credit Default Swaps came into being in the late 1990s, and this market played an important role in the mortgage market in the 2000s. In particular, it played an important role in the markets for Mortgage-Backed Securities and Collateralized Debt Obligations since CDSs made MBSs and CDOs more attractive to those who sought protection against the risk of these kinds of bonds defaulting. Some regulated institutions could reduce their capital requirements by purchasing credit default protection against the MBSs and CDOs they held, and hedge funds and other financial institutions could use CDSs to hedge positions that involved MBSs, CDOs, or other forms of Asset-Backed Securities.

Insurance is generally subject to government regulations that force insurance companies to maintain reserves commensurate with their obligations to policy holders. In addition, insurance companies generally refuse to issue insurance policies where the beneficiary of the policy does not have an insurable interest in what is being insured. In particular, they bar people from obtaining insurance on property they do not own or on which they will not otherwise suffer a loss if the property is destroyed or damaged. In addition, people are generally not allowed to insure property for more than the damages they will incurred if the property is lost or damaged. But even though CDSs are a kind of insurance, the Commodity Futures Modernization Act (CFMA) passed in 2000 explicitly blocked regulation of the market for Credit Default Swaps. This made it possible for financial institutions to purchase and sell Credit Default Swaps 1) to insure debt instruments that were not owned by the purchaser, 2) to purchase and sell multiple CDS contracts against these same debt instruments, and 3) for financial institutions to sell CDS insurance contracts without setting aside reserves against the contingency that a credit event covered by their contracts might actually occur and they would have to honor the terms of their contracts. It also made synthetic CDOs possible.

Synthetic CDOs

A synthetic CDO offering is structured in the same way an ordinary CDO offering is structured, but there are a number of important differences between synthetic and ordinary CDOs. The first is that the Special Purpose Vehicle (SPV) that creates a synthetic CDO sells Credit Default Swaps and holds safe securities (such as government bonds) as collateral instead of purchasing and holding the debt instruments that underlie the CDO. The way this works is the sponsor of a synthetic CDO incorporates a SPV and puts together a list of debt instruments for which the sponsor wishes to sell default protection. The SPV then sells Credit Default Swaps to those who are willing to pay a premium for default protection on the listed securities. These Credit Default Swaps sold by the SPV are the primary earning assets of the SPV.

The SPV then structures an offering of synthetic CDO tranches similar to the structure of the MBS offering shown in Figure 8.1 with the same kind of subordinated payout to the investors in the synthetic CDOs that is used in the payout structure of an ordinary CDO or MBS. The proceeds from the sale of the synthetic CDOs are, in turn, invested in safe securities. These safe securities (government bonds, for example) become the collateral held by the SPV. The interest payments received from these securities combined with the premium payments received from the Credit Default Swap (CDS) contracts sold by the SPV provide the funds needed to make the interest and principal payments to those who invest in the SPV.

This brings us to the second way in which synthetic CDOs differ from ordinary CDOs. There are two kinds of investors in a synthetic CDO. The first is the fully-funded investor described above. Fully-funded investors are required to put up 100% of the money they are putting at risk. They actually lend money to the SPV in order to receive interest payments on the CDOs they purchase. This money is used to purchase the safe assets that the SPV uses as collateral.

The second kind of investor is the unfunded investor. Unfunded investors are not required to put money up front and do not lend money to the SPV. Instead, unfunded investors, in effect, sell credit-default protection to the SPV—protection that insures payment to those who purchased Credit Default Swaps from the SPV. All other investors are subordinate to the unfunded investors in a synthetic CDO offering, which means, of course, that all other investors in a synthetic CDO get paid after the unfunded investors get paid. This adds another level of subordination to the tranche structure of the synthetic CDO, namely, what is referred to as the super-senior tranche that is sold to unfunded investors.

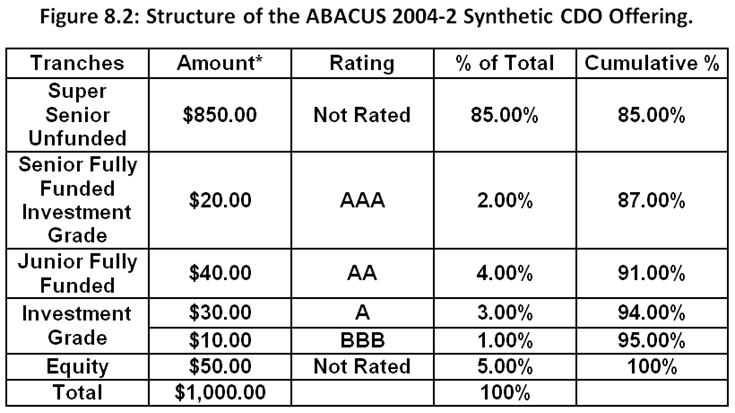

The way in which synthetic CDOs are structured is illustrated in Figure 8.2 which shows the structure of the ABACUS 2004-2 offering sponsored by Goldman Sachs in 2004. In spite of the obvious differences between Figure 8.2 and Figure 8.1, they are very much the same in that 87% of the synthetic CDOs in Figure 8.2 are rated AAA or are subordinated above the triple-A tranches compared to 78% of the MBSs in Figure 8.1, and only 5% are rated less than investment grade in Figure 8.2 compared to 4% in Figure 8.1.

Source: Financial Crisis Inquire Commission.

In terms of the payout from the investment, there is no difference between a synthetic CDO sells credit default swaps against MBSs and holds safe investments and an ordinary CDO that actually holds the MBSs insured by the synthetic CDO. If there are no defaults in the underlying MBSs the CDO investors will all get paid whether the CDO is synthetic or not. If some of the underlying MBSs in a synthetic CDO default, some of the investors who purchased the lower tranches of the synthetic CDOs will not get paid as some of the safe securities will have to be sold to pay the CDSs that insured those MBSs in the synthetic CDO. But the same would be true if those investors had invested in the lower tranches of an ordinary CDO sold by an SPV that actually held the MBSs that defaulted. It makes no difference from the perspective of the payout to the investor what form the CDO takes. In either case, the amount the investor gets paid or looses is the same.

There is, however, a fundamental difference between investing in a synthetic CDO and investing in an ordinary CDO in terms of the kind of investment being made. Investors who purchase ordinary CDOs are investing in the mortgage business. The money they are investing is used to purchase mortgages—albeit indirectly by way of financing the tranches of the CDOs that are used to purchase MBSs that are used to finance the purchase of mortgages.

Investors who purchase synthetic CDOs are investing in the insurance business, not the mortgage business. The money they are investing is used to insure the debt instruments that underlie the Credit Default Swaps sold by the SPV, not to purchase mortgages. In addition, the collateral held by the SPV is not put up by the borrowers. It is put up by the lenders—those who purchase the synthetic CDOs. And it is not held to protect those who lend by purchasing the synthetic CDOs; it is held to protect those who purchase the Credit Default Swaps that are sold by the SPV. In the case of a default on an underlying asset, the collateral is sold to pay the CDS holders, not the synthetic CDO holders.

Not only were the fully funded investors in synthetic CDOs investing in the insurance business, they were investing in the insurance business in an unregulated market. There were no government regulations that prevent those who were buying the MBS insurance offered by the SPV from being the very same people who selected the MBSs that were being insured. The conflict of interest here should be obvious; especially since the people who purchased the insurance and selected the MBSs to be insured did not have to own the MBSs they had selected. They had nothing to lose if the MBSs they selected to insure went bad, and they receive a huge payout if the MBSs they selected did in fact go bad.

Initially, the institutions that sold Credit Default Swaps were pretty much limited to AIG and a few monocline insurance companies such as MBIA and Ambac, but with the invention of the synthetic CDO the major players in the MBS and CDO markets such as J. P. Morgan and Goldman Sachs were able to secure credit protection from an ever increasing number of investors through the sale of the fully-funded, synthetic CDOs. All that was required to sell a fully-funded synthetic CDO was to find a buyer who

1. had enough money to make the purchase,

2. sought the safety of the investment-grade rating of these bonds seemed to provide, and

3. was unable to understand exactly what it was that was being purchased.

Investment-grade, fully-funded, synthetic CDOs were sold to banks, pension funds, endowment funds, hedge funds, mutual funds, insurance companies, and municipal governments throughout the country and all over the world. Virtually any entity that met the above criteria was fair game to those who sold these securities. (FCIC WSFC)

Finally, as is clear from the way in which the synthetic CDOs were structured, those who bought the unfunded, super-senior tranches were given added protection from loss by the fully-funded tranches since the fully-funded tranches were subordinated to the super-senior tranches and took the first losses. This was particularly appealing to many of the institutions that sponsored synthetic CDOs since these institutions did not have to put up cash to purchase the Super-Senior tranches they had created and could receive income from these tranches without having to set aside capital to support them. As a result, many of the super-senior tranches of the synthetic CDOs ended up on the books of the financial institutions that sponsored these CDOs, much to their regret when the crisis came. In other words, these institutions assumed the risk of selling credit-default protection to the SPV, a practice that proved disastrous in the fall of 2008. (FCIC WSFC)

Shadow Banks, Derivatives, and Systemic Risk

The systemic risk the shadow banking system posed—that is, the threat to the financial and economic systems as a whole—especially when combined with unregulated derivative markets that operated without exchanges or clearinghouses, should have been obvious to regulators, but ideological blindness inspired by an almost religious faith in free markets made it impossible for policy makers and elected officials to even see this kind of risk let alone take it seriously. When this blindness was combined with the fact that the vast majority of our elected officials knew virtually nothing about the history of the financial system, the stage was set for the financial crisis that began in 2007 and reached its climax in 2008.

The irony is that the first run on a shadow bank occurred fully ten years before the entire shadow banking system collapsed in the fall of 2008 when a run on a single hedge fund, Long-term Capital Management, nearly caused a worldwide financial meltdown in 1998. This run caused a near panic among policy makers and within the financial community at the time, and, yet, as we will see, nothing was done to curb the excesses of the shadow banking system or to regulate the over-the-counter derivatives markets in the wake of this near disaster.

Endnotes

[44] The ratings, AAA, BBB, etc., represent the rating agencies estimate of the probability of default for the security being rated based on the historical performance of securities that have held that particular rating in the past. The ten year time horizon for the historical performance of Moody’s ratings from 1970-2010 is given in Moody’s Confidence Intervals for Corporate Default Rates.

[45] It should be noted reserve and capital requirements are not the same thing. Capital requirements define the amount of equity an institution must have relative to its assets (or liabilities) and are designed to limit the total amount of leverage the institution can achieve. They are designed to minimize the solvency problem of the institution. Reserve requirements limit only deposits and are designed to minimize the liquidity problem of depository institutions. In addition, just as there are different reserve requirements for different kinds of deposits, there are different capital requirement for holdings of different kinds of assets in different kinds of regulated institutions. See Feinman for a discussion of how reserve requirements are determined. The determination of capital requirements is discussed in Baily. See Tobin for a discussion of the kinds interactions that take place within the financial system that determine the reserve positions of banks.

[46] It is worth noting that a futures contract only hedges against the risk of adverse price changes. It does not hedge against other kinds of risks such as the possibility of adverse weather conditions that the farmer may have to face.

[47] It should be noted that given the fact that futures contracts generally require the counter parties to maintain their margin requirements as the values of their contracts fluctuate, it is very unlikely that anyone would suffer an actual loss of this magnitude on a futures contract. It is most likely that at some point they would choose to cut their losses and liquidate their contract as the market turned against them rather than try to wait until the market turned in their favor. Even if they did try to wait it out they would have to be able to meet the margin requirement as their losses accumulated. When they ran out of cash and could no longer meet their margin requirement their position would be liquidated by their counterparty. In general, only if they chose to wait it out and have sufficient resources to meet their margin calls would their loss be this great. It is possible, however, that the market could change so quickly that neither party to a futures contract is able to liquidate the contract before this kind of loss occurred.

[48] Interest Rate Swaps comprised the largest segment of the derivatives market in 2008 (52%) and in 2013 (65%), but since they appear to have played a relatively minor role in the financial crisis (other than by adding to the degree of uncertainty and apprehension) they are not discussed here. See: BIS and FCIC.