It Makes Sense

If You Don’t Think About itGeorge H. Blackford, 2011

I recently received an email that began with the question “If any other of our presidents had doubled the National Debt, which had taken more than two centuries to accumulate, in one year, would You have Approved?” This seems like a rather innocuous question. After all, the only thing it actually says is that it took two centuries to accumulate the national debt. The question does not even say Obama doubled the debt. Instead it asks if you would approve if any other president had done this and allows you to come to this conclusion on your own.

What most people fail to realize is that as you think about this question the complex of negative feelings and associations that exists in your mind regarding the debt crisis is brought to the surface, and your conclusion that Obama doubled the debt becomes part of that complex. As a result, simply by asking this question the person who wrote it is able to connect those negative feelings and associations, including your conclusion about doubling the debt, to the way you think about Obama. The writer doesn’t actually tell you what negative associations and connections to make. He simply leaves it to your imagination to come to conclusions, fill in the details, and make the connections without actually telling you what to do or think in this regard.

This technique is quite common in propaganda. It uses innuendo to generate ideas in your mind rather than clearly stating what it wants you to think, and there is a reason why this technique is used. By asking the question in the form “If any other of our presidents . . . would You have Approved?” it focuses your attention on whether or not you approve. This may seem to be a perfectly harmless way to ask a question, but it is not. By focusing your attention on whether or not you approve, the propagandist is directing your attention away from the insinuated accusation that Obama doubled the debt, and in order to answer the question you are actually asked you have to assume this accusation is true without actually thinking about whether or not it is true.

As you ponder the question, all of the negative feelings you have toward the debt being doubled are being connected to Obama in your mind whether the accusation that he did this is true or not. The only way you can keep this from happening is by consciously thinking about the accusation and rejecting it. The problem is that most people don’t even know what the national debt is let alone whether or not Obama actually doubled it in a single year. As a result, it is very difficult for most people to consciously reject this accusation even though it is patently false.

The Net National Debt increased 29.3% during Obama’s first year in office and by 20.0% during his second year. Neither increase even comes close to the 100% increase insinuated in the question. The Gross National Debt increased by even less, only 19.0% and 13.4%, during Obama’s first two years in office.[1]

The Dangers of Propaganda

The reason propaganda is so dangerous is that the complex of negative conclusions, feelings, associations, and connections that build in your mind as a result of propaganda are derived from false information. Much of this complex is a figment of your own imagination, guided by the way in which the false information is presented to you by the propagandists, and as your exposure to propaganda grows the complexes created in your mind by the propagandists grow as well. The effect is to drive you deeper and deeper into the imaginary world the propagandist is creating for you, and further and further out of touch with reality.

This process gives the propagandist the power to control the way you think as he guides the creation of this imaginary world for you, and given the way in which this world is created—by suppressing rational thought and playing on your prejudices, insecurities, and ignorance to generate fear, anger, and hatred toward the subject of the propaganda[2]—when you succumb to propaganda you are susceptible to believing just about anything, no matter how outlandish it may be. Things begin to make sense simply because they are consistent with the imaginary world the propagandist has created in your mind, and eventually you become convinced that only the propagandist makes sense, and those who see the real world as it actually is are nuts. And all of this takes place without the propagandist actually telling you what to think. You are able to figure it out all by yourself, or so it seems.

For the past forty years the American people have been literally bombarded by an onslaught of propaganda that has been very effective in controlling the way people think.[3] Not only has it deluded a substantial portion of the population into believing outlandish things that are trivial—such as that Obama is a secret Muslim or that he was not born in the United States—it has deluded a substantial proportion of the population into believing things that are outright dangerous, the most obvious being that Saddam Hussein participated in 9/11 and was threatening our country with nuclear weapons. But this is only the most obvious example of how dangerous the delusions created by propaganda have been. The most dangerous delusions have to do with our economic and political systems.

Antigovernment Propaganda and Freedom

Over the past thirty years those who fund the propagandists—the Wall Street bankers, corporations, hedge fund managers, corporate executives, and countless others who live in the rarefied atmosphere of multimillion and billion dollar fortunes and who earn tens of millions of dollars in a single year[4]—have been able to convince the American people that our government is our enemy and that we must defend ourselves against this enemy by dismantling the agencies our democracy has put in place to regulate the economy. The implicit assumption that we must dismantle our government in order to save ourselves from our democracy is a rather strange idea if you think about it, but for those who live in the imaginary world of the propagandists this makes perfect sense. After all, government regulations limit our FREEDOM, and in a FREE society the government has no right to tell us what to do. End of discussion, end of thought.

It is obvious when you think about it, however, that the reason those who fund antigovernment propaganda wish to get rid of our regulatory agencies is that they can benefit greatly if they don’t have to abide by government regulations—that is, if they don’t have to provide safe working conditions for their employees; if they don’t have to ensure that the food, drugs, and other consumer products they sell are safe, and if they are not prevented by the government from creating environmental and economic catastrophes in the wake of their economic endeavors.

Make no mistake about this: Antigovernment propaganda is not about your freedom to live your life without government oppression in the imaginary world the propagandists are trying to create in your mind. It’s about the freedom of those who fund this propaganda to prey on the weak and vulnerable without fear of government intervention in the real world in which you and those who fund this propaganda actually live. If you have any doubt about this, consider the effects of their forty year campaign to deregulate our financial system.

Under the guise of making you free, those who fund antigovernment propaganda managed to dismantle much of the regulatory system put in place since the 1920s to prevent the kinds of reckless and irresponsible behavior on the part of financial institutions that led to the Crash of 1929 and the Great Depression of the 1930s. Beyond that they managed to cut the funding that went to the financial regulatory system and to put people in charge of what little remained of that system who did not believe in regulation and who were willing to ignore their responsibility to enforce existing laws and regulations against fraud and predatory lending practices.

And what did the financial institutions do with your new found freedom from government regulation of the financial system? They took the opportunity to turn our financial system into a giant casino as predators crawled out of the woodwork and corrupted the system virtually without restraint.

The result was the Drexel Burnham Lambert, Charles Keating, Michael Milken, Ivan Boesky, and countless other insider trading, junk bond, and Savings and Loan frauds that led to the junk bond and commercial real estate bubbles of the 1980s.

In the 1990s, the HomeStore/AOL, Enron, Global Crossing, and WorldCom frauds along with countless more insider trading and investment advisor frauds led to the dotcom and telecom bubbles. Following the dotcom and telecom bubbles the major commercial, savings, and investment banks decided to securitize subprime mortgages that were fraudulently obtained by the likes of Washington Mutual, Countrywide, IndyMac, New Century, Fremont Investment & Loan, and CitiFinancial and to distribute securities backed by these fraudulently obtained mortgages throughout the entire world.

All of this was a direct consequence of the deregulation of our financial system, the defunding of our regulatory agencies, and the refusal to enforce existing laws and regulations against insider trading, stock manipulation, fraud, and predatory lending practices. And how did those who funded the movement to deregulate our financial system in the name of your freedom make out as a consequence of this deregulation?

The answer to this question can be seen in the following graph constructed from the official IRS statistics assembled by Piketty and Saez and made available on line in the form of an Excel worksheet at http://elsa.berkeley.edu/~saez/TabFig2008.xls. This graph shows how the average real income of the top 0.01% of the income distribution changed since 1960.

As is shown in the graph, the income of this group remained relatively stable during the pre-deregulation period from 1960 through 1980 then increased sporadically from 1980 through 2008 as deregulation began in earnest. The average income of this group, measured in 2008 prices, stood at $5.4 million in 1980 and reached a high of $36.4 million in 2007. What is particularly interesting in this graph, however, is the way the sporadic spikes in income correspond to the epidemics of fraud that occurred during this period.

The average real income of the top 0.01% increased from $5.4 million per year in 1980 to $15.9 million in 1986—a 194.4% increase during the Drexel Burnham Lambert, Charles Keating, Michael Milken, Ivan Boesky, and other insider trading, junk bond, and Savings and Loan frauds of the 1980s.

During the HomeStore/AOL, Enron, Global Crossing, WorldCom, and other insider trading and investment advisor, dotcom, and telecom bubble frauds of the 1990s the average income of this group increased from $10.4 million a year in 1994 to $29.8 million in 2000—a 186.5% increase.

During the subprime mortgage fraud the increase was from $16.3 million in 2002 to $36.4 million in 2007—a 123.3% increase. [6]

And how did the rest of us fare through all of this? The bursting of the junk bond, and commercial real estate bubbles caused by the frauds of the 1980s created the first financial crisis in the United States since 1929 as some 1,300 savings institutions failed, along with 1,600 banks. It cost the American taxpayer $130 billion to clean up the mess as we bailed out the insured depositors in these failed institutions, and over 3 million people lost their jobs in the 1990-1991 recession brought on by this crisis. The bursting of the dotcom and telecom bubbles caused by the frauds of the 1980s led to the 2001 recession where, again, over 3 million people lost their jobs, but all of this pales in comparison to the disaster brought on by the bursting of the housing bubble created by the subprime mortgage fraud.[5]

According to the Financial Crisis Inquiry Commission, over 8 million people lost their jobs since the housing bubble burst in 2007. Four million families had lost their homes by the end of 2010 and another 4.5 million families were seriously behind in their mortgage payment or in the process of foreclosure. “In the fall of 2010, 1 in every 11 outstanding residential mortgage loans in the United States was at least one payment past due but not yet in foreclosure.” Nationwide, 10.8 million families—22.5% of all families with mortgages—owed more on their mortgages in 2010 than their houses were worth. In Florida, Michigan, and Nevada more than 50% of all mortgages were underwater, and the Commission projected that by the time this crisis is over as many as 13 million families could lose their homes.

It cost the taxpayer $700 billion to fund TARP in order to bail out the banks that caused this mess, over 380 banks had failed by June of 2011 since this crisis began, and the FDIC is going to have to shell out countless hundreds of billions of dollars before it is over. Then there is the effect of the ensuing recession on increasing the deficit in the federal budget to over a trillion dollars.

This is what forty years of propaganda and deregulation have wrought, and this is what the antigovernment propaganda is all about. It has nothing at all to do with your personal freedom as the propagandists would have you believe. It is about the ability of those who fund this propaganda to make money at the expense of the rest of the population through fraud and corruption, nothing more.

Good Government Isn't Free

The idea that deregulation will make you free is not the only dangerous idea that those who fund antigovernment propaganda would have you to believe. Equally dangerous is the idea that we can have good government without paying for it. Not only is this idea absurd on its face to anyone who thinks about it, we have been operating under this assumption for the past thirty years, and it clearly hasn’t worked.

We cut taxes in the 1980s and 2000s, and we have been cutting government programs one after another for the past thirty years. This, clearly, has not led to a better education system, a better transportation system, or better law enforcement. Our environment and public health have not improved, and cutting taxes and government programs did not lead to economic stability or prosperity.

All that was accomplished as a result of this policy was a failure of government to protect the public from those who would prey on the rest of us as the special interests took over our government. Those government programs and services that provide for the common good were cut while those that serve the special interests were expanded. The end result was a reduction in taxes paid by the wealthy, an increase in taxes paid by the not so wealthy, and an explosion in the national debt. This sort of thing is inevitable when people are focused on the propaganda and fail to think about the substance of what the propagandist is asking them to believe.

In the imaginary world of the propagandist you are asked to believe that all of the waste, fraud, and abuse in government is to be found in the social welfare system, in the government regulatory agencies, and in the general operations of the government. In this imaginary world we can achieve all of the benefits of good government without having to pay for them by simply cutting taxes, eliminating welfare and government regulations, and cutting the size of government.

But in the real world, welfare, the regulatory agencies, and the general expenditures of the government comprise a very small part of the budget. In the real world the bulk of the budget is in Defense, Social Security, Medicare, and Medicaid, and if we truly want to balance the budget and pay less taxes this is where the cuts must be made—in defense, Social Security, Medicare, and Medicaid—not in the regulatory system, welfare, and the general operations of government.[7]

Focusing your attention on cutting taxes, welfare, and the regulatory agencies gives those who fund the propagandists a free hand to do what they will with the rest of the government. That serves their ends very well, but it doesn’t serve the ends of the rest of us. And it all makes sense in the imaginary world of the propagandists—if you don’t think about it.

Social Security, Medicare, and Taxes

Ignoring the reality of the federal budget and relying on tax cuts and eliminating welfare and government regulations to solve our problems has led to a serious imbalance in the federal budget. At the same time, a substantial portion of the electorate believes that we can maintain Social Security and Medicare while we cut other government expenditures to bring the budget back into balance without raising taxes. This belief is simply a lie fostered by propaganda, and it is relatively easy to understand why those who fund the propaganda that fosters this lie want you to believe it.

After all, they make fortunes when the government doesn’t regulate their behavior, and if they don’t pay taxes they don’t have to give any of that money back. What’s more, the multi millionaires and billionaires who fund antigovernment propaganda simply do not care about Social Security and Medicare. When you are making tens of millions a year and have hundreds of millions to fall back on, you don’t have to care about Social Security or Medicare or unemployment compensation or Medicaid or food stamps or any other social-insurance program that ordinary people must rely on when they reach old age or when they find themselves unemployed in the midst of an economic catastrophe brought on by unregulated bankers and speculators.

When you are making that kind of money and have that kind of fortune you can live off your wealth whether you are employed or not, in a gated community with private security guards, and you can hire a phalanx of lawyers to protect your rights against those who would take unfair advantage of you. In other words, you can live your life just as the wealthy elites in third world countries live their lives where wealth controls the government and the government serves only the elites.

All that the people who fund antigovernment propaganda care about is taxes, and as I said above, so long as they don’t have to pay taxes they don’t care about Social Security or Medicare, and they most certainly do not care about the national debt. This last point is extremely important to understand because so long as they don’t have to pay taxes, those who fund antigovernment propaganda actually make money off the national debt. They not only collect the interest paid on this debt, the more the government borrows to finance purchases, the greater the profits they can add to their bank accounts. They simply do not care about the national debt so long as they don’t have to pay taxes in order to finance government expenditures because those expenditures increase their wealth.

It’s all so simple in the imaginary world of the propagandist. All we have to do is keep cutting taxes, welfare expenditures, and regulations, and the government’s fiscal problems will just go away. There is no need to cut Social Security, Medicare, or Defense in this world or to raise taxes in order to balance the budget. All we have to do is cut taxes. In the real world, however, this is nonsense. The national debt must continue to increase until we either raise taxes or cut Social Security, Medicare, or defense, but it cannot continue to increase forever, at least not faster than GDP. Sooner or later something has to give.

When we look at Social Security we find that over the past thirty years Social Security has built up a $2.5 trillion trust fund that by everyone’s estimate should carry the system through 2036. This trust fund is invested in United States government securities backed by the full faith and credit of the United States government. But if this trust fund is to be used to finance the Social Security System it must be converted into cash, and the only way the government can convert it into cash is either through taxes or by borrowing money. And the only way the government can avoid having to borrow money or come up with the tax revenue needed to redeem Social Security's $2.5 trillion trust fund is by eliminating Social Security benefits. This is simply a real world fact, and no amount of propaganda can change this fact.

As a result, the viability of the Social Security System depends crucially on the fiscal soundness of the federal government, and in today’s world the federal government cannot be made fiscally sound without raising taxes. And this does not mean simply raising taxes on the top 2% of the income distribution. In order to make the federal government fiscally sound and at the same time maintain essential government services at the levels people want them to be maintained—specifically, in order to maintain Social Security and Medicare—not only must we raise taxes beyond the top 2% of the income distribution, we must eliminate tax loopholes such as the special treatment of income from capital gains and dividends. If we do not do this, not only will the federal debt continue to grow and the government not be made fiscally sound, the government will not have the revenue needed to redeem the $2.5 trillion worth of government bonds in the Social Security trust fund, and the viability of Social Security will be seriously in doubt.[8]

Not only is it impossible to maintain Social Security in the real world without raising taxes, it is impossible to maintain Medicare even if we do raise taxes unless we also totally reorganize our healthcare system.

The entire American healthcare system is a mess. Our crazy-quilt, patchwork healthcare system is the least efficient among the developed countries of the world. (NYT IOM JAMA1 JAMA2) We spend more per person and as a percent of GDP than any other country that has better health statistics than we do. At the same time, we rank 51st in terms of life expectancy, 51st in terms of infant mortality, 24th in terms of the availability of doctors, and 37th in terms of the overall performance of our healthcare system.

Our multiple-third-party payment system, whereby providers decide what services patients need and how much to charge while insurance companies or the government pick up the tab virtually guarantees continually deteriorating quality and increasing costs since there is no incentive in this system to deliver quality healthcare services in a cost effective manner. It also virtually guarantees that a continually increasing share of the healthcare costs will be passed on to the government as these costs rise and fewer and fewer people are able to afford these rising costs.

Every advanced country in the world that has better health statistics and lower healthcare costs has abandoned the cost ineffective multiple-third-party payer system for a single-payer, universal healthcare system that provides government subsidized healthcare for all—paid for through taxes—where costs are controlled through government negotiated prices. They pay higher taxes than we do, but their higher taxes are more than offset by the savings in insurance premiums and lower healthcare costs—not to mention the fact that they are healthier than we are, and they live longer than we do.

The simplest, most efficient, and most cost effective way to provide a comparable system for the United States would be to extend the Medicare program to the entire population. This program works, and the institutions necessary to run it are already in place. It would take very little effort to retool Medicare to meet the needs of the entire population compared to the massive and wasted effort it is going to take to implement the Patient Protection and Affordable Care Act.

This is the real world choice facing the American people today: We can either increase taxes and reorganize our healthcare system and thereby maintain Social Security and Medicare, or we can refuse to increase taxes and cut Social Security and Medicare. The only alternative is to continue to increase the national debt until the system collapses, and anyone who tells you otherwise is either deliberately lying to you or is living in the imaginary world created in their mind by propagandists and is totally out of touch with reality.

It’s only when you insist that the government be financed through taxes that those who fund the antigovernment propaganda machine acknowledge this choice. They then point at the national debt, allege that we can’t afford Social Security and Medicare, and demand that these programs be cut. This makes perfect sense in the imaginary world of the propagandist, if you don't think about it, where it is conveniently ignored that the reason we can no longer afford Social Security and Medicare and at the same time balance the budget is because of the massive tax cuts that were given to force cuts in the rest of the government—tax cuts that, as strange as it may seem, led to the explosion in the national debt in the first place and didn’t solve our problems.

The Moment of Truth

The reality of the choice facing the American people today is made quite clear in The Moment of Truth report written by Alan Simpson and Erskine Bowles, the co-chair of the President’s National Commission on Fiscal Responsibility and Reform. This report puts forth a comprehensive plan to resolve our deficit problem that includes both Social Security and healthcare reform as well as a reform of the tax code.

In dealing with Social Security, Simpson and Bowles recommend cutting benefits to cover 73% of the expected shortfall in Social Security revenues over the next 75 years and expanding the Social Security tax base to cover an additional 43% of the shortfall. (Presumably, the redundant 16% is there to maintain the Social Security trust fund so that it will not have to be converted into cash.)

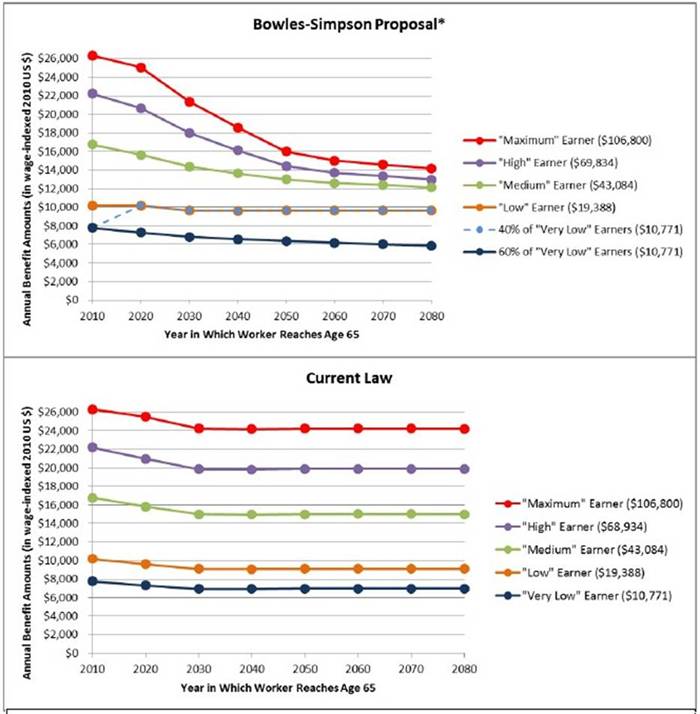

In the process, the Social Security benefit payout structure is reduced in such a way that the majority of those who participate in the system will get far less out of it than they pay in. As can be seen from the following graph from the Strengthen Social Security website, reducing the payout structure in this way has the effect of converting Social Security from an insurance program in which the expected benefits are proportional to the contribution the beneficiary is expected to pay, into a welfare program in which the expected benefits for high-wage earners are disproportionately lower relative to what they pay in than they are for the low-wage earners.

This is not Social Security as we know it.

What’s more, under the Simpson-Bowles scheme this welfare program would be financed through the payroll tax—a highly regressive tax that takes a much larger proportion of the incomes of low and middle-income earners than it takes from high-income earners. This is hardly an equitable way to finance a welfare program. The burden of financing a welfare program should fall heaviest on those who can afford to pay. It should not fall heaviest on the backs of the working poor as Simpson and Bowles propose.

In dealing with healthcare, the main thrust of the Simpson’s and Bowles’s recommendations is to reduce the third-party payer problem by forcing healthcare recipients, both public and private, to pay a larger proportion of the cost out of pocket. But this scheme can only reduce costs to the extent the government doesn't intervene, and those who cannot afford to pay are forced out of the healthcare system since to the extent the government picks up the tab for those who cannot afford the added cost there is no saving. As with the Simpson-Bowles scheme for Social Security, this is not Medicare as we know it.

This scheme begs the question: How many of those who cannot afford to pay the added costs should be allowed to suffer or die for want of healthcare in order to minimize the cost of healthcare for those who can afford to pay? It is the ultimate death-panel plan whereby those who cannot afford the added costs are allowed to suffer and die. The only alternative is for government to pick up the tab which will inevitably increase the cost of healthcare for the government.

When it comes to taxes, the Simpson-Bowles report recommends treating dividends and capital gains as ordinary income, closing corporate tax loopholes, and a few other changes that will make the tax code more progressive. It then goes on to recommend the top marginal income tax rate paid by the wealthy be decreased from 35% to 28%, that the marginal income tax rate paid by middle-income earners be set at 22%. It also recommends that the lowest income tax rate paid by the not so wealthy be increased from 10% to 12%, and that maximum corporate tax rate be cut from 35% to 28%. These changes in tax rates are particularly interesting.

If this tax rate structure is passed into law it will mean that the combined 15.3% employee/employer payroll tax rate plus the income tax rate in the lowest income bracket will equal 26.3%—less than two percentage points below the maximum marginal rate corporations and multibillionaires will pay. Those in lower end of the middle tax bracket will face a combined marginal rate of 36.2%—8.2 percentage points above the marginal rate multibillionaires and corporations will pay.

The wealthy were given massive tax breaks over the past thirty years as the top income tax bracket was cut from 70% to 35%, the capital gains tax was cut from 28% to 15.7%, the top tax bracket on dividends was cut from 70% to 15%, the maximum estate tax rate was cut from 70% to 35%, and the top corporate tax rate was cut from 50% to 39.3%. At the same time, the payroll tax rate paid by lower-income earners was increased from 12.1% to 15.3% in order to build up the combined Social Security and Medicare trust fund to $2.9 trillion. These trust funds were then lent to the government to partially compensate for the revenue lost from the above tax cuts.

In the meantime we deregulated our financial system and allowed our financial institutions to create epidemics of fraud that ultimately led to the worst economic catastrophe since the Great Depression. And now—in the name of fiscal responsibility and in order to ‘save’ Social Security and Medicare—we are supposed to reward those who perpetrated this fraud by cutting their taxes even further as we drastically cut Social Security benefits and increase the cost of Medicare to its recipients? Something is terribly wrong here, and yet, in the imaginary world of the propagandist this all makes sense—if you don’t think about it.

Instead of allowing you to think about the substance of their recommendations and how we got into this mess in the first place, the Simpson-Bowles report focuses your attention on the seriousness of the fiscal problem that has resulted and asks you to believe that their scheme is a reasonable bipartisan compromise on the part of all interested parties. This makes perfect sense in the imaginary world of the propagandist where the substance of the proposed changes in Social Security, healthcare, and taxes are ignored, and the way in which we got into this mess in the first place is ignored as well. When we look at the substance of the proposed changes in light of the way we got into this mess in the first place, it makes no sense at all.[9]

The fiscal problems we face in the real world today are the direct result of the massive tax cuts given to the wealthy over the past thirty years combined with the massive increases in defense expenditures squandered in Iraq and the devastating recession brought on by the fraudulent, reckless, and irresponsible behavior of those who run our financial institutions that was made possible by financial deregulation. Clearly, these problems could be solved by simply rescinding the tax cuts that created our fiscal problems in the first place, increasing the payroll tax base to cover a larger portion of earned income, dedicating the estate tax to contributing to the Social Security trust fund, treating capital gains and dividends as ordinary income, extending Medicare to the entire population, controlling defense expenditures in a sensible way, and reregulating the financial system to keep those in charge of our financial institutions from creating in the future the kind of mess they have always created for us in the past when they were free of government regulation.[10]

This isn’t rocket science. Anyone who looks at the numbers and thinks about how we got into this mess should have no trouble figuring this out. It’s called paying for what you get. If you want good government you have to pay for it, and the way you pay for it is by paying taxes. What’s more, I am quite certain that if given a choice between increasing taxes, funding Social Security, and extending Medicare to the entire population or adopting the recommendations of the Simpson-Bowles report, the vast majority of the American people would choose to junk the Simpson-Bowles scheme and choose to increase taxes and extend Medicare as I have suggested. Unfortunately, we are not going to be given this choice.

How Things Work

Most Americans want good government and would be willing to pay for it if they were given a choice, but, as I have said, we are not going to be given a choice. This is a real world choice. It’s not a choice that exists in the imaginary world of the propagandist, and our major political parties are not willing to defy those who have created this imaginary world in order to give the American people a real world choice.

It is obvious that the Republican Party is not going to give the American people this choice. The Republican Party is dead set against any kind of tax increase. Its leadership as well as its membership is firmly ensconced in the imaginary world of the propagandist beyond any hope of redemption. After all, the Republican Party created most of this imaginary world in the first place.[11] To a Republican, anyone who even thinks about increasing taxes is nuts. There is no possibility at all that the Republican Party will offer this choice to the American people.

It is also obvious that the Democratic Party is not going to give the American people this choice. The leadership of the Democratic Party is dead set against doing anything that will endanger the flow of cash it receives from the Wall Street bankers, hedge fund managers, corporate executives, and countless others who earn tens of millions in a single year and who most definitely do not want their taxes increased and whose ultimate goal is to eliminate all social-insurance programs, not just Social Security and Medicare, but unemployment compensation, food stamps, welfare, Pell grants, and all other government programs that do not serve the interest of the multimillionaires and billionaires who fund the antigovernment propaganda machine. So long as the government funds these programs with borrowed money, they don’t care since, as noted above, this adds to their profits and bank accounts. It is a different story if the government tries to fund these programs with taxes.

This puts the leadership of the Democratic Party in an awkward position since a significant portion of its base is not firmly ensconced in the imaginary world of the propagandist and is willing to look at the world as it really is. As a result, the leadership of the Democratic Party is forced to talk about increasing taxes or controlling healthcare costs through a single-payer option or extending Medicare to the entire population, but it is not willing fight for these proposals by turning them into campaign issues and explaining to the American people what their options are. Doing this would not only threaten their campaign contributions, it would threaten their ability to move into the private sector with six or seven figure incomes after they lose the next election.

Instead, in an attempt to placate their base, the leadership of the Democratic Party talks about these issues just enough to blame Republicans for blocking whatever it is that the Democrats say they want to accomplish. At the same time, they are careful to make certain that nothing actually gets done that will offend those who feed them the cash. Thus, there is also no possibility that the Democratic Party will offer a real world choice to the American people, and there does not seem to be a third party out there willing to take on the challenge.

This is the way our political system has worked for the past thirty years where the imaginary world of the propagandist has ruled supreme, and there is no reason to expect this will change anytime soon. As a result, we can expect nothing to get done toward solving the fiscal problems of the government until after the next election, and that election will be fought in the imaginary world of the propagandists where the Simpson-Bowles scheme will be presented as the only sensible way to look at the world.

Those who try to talk about the substance of this scheme and relate it to how we got into this mess in the first place will be vilified as unpatriotic, ignorant, and selfish—obstructionists who are only looking out for themselves rather than for the good of the country. Besides, they are obviously just plain ignorant and lack the mental capacity to understand how serious the problem is. Otherwise, they would be able to figure out on their own why the Simpson-Bowles scheme is the only framework in which it is possible to solve our fiscal problems.

Once the election is over, and the Republicans have taken over the Senate and increased their majority in the House—and the losing Democrats have moved on to their six and seven figure incomes in the private sector—we can then look forward to some form of the Simpson-Bowles scheme being passed by Congress. The final bill will not contain those provisions that are progressive, such as treating capital gains and dividends as ordinary income, and its passage into law will mark the end of Social Security and Medicare as we know them, but it will be signed into law no matter who the president may be.

If Obama survives the carnage of the next election there is certainly no reason to think he will veto such a bill. After all, Obama’s main goal in life is to bring people together in order to get things done, and the bill he will be asked to sign will most certainly get things done. There is every reason to believe that after bemoaning the fact that he doesn’t approve of all of its provisions, Obama will dutifully sign it into law.

If Obama does not survive the next election, there is every reason to believe that the new Republican president will also bemoan the fact that he or she also does not approve of all of its provisions, but will sign the bill into law anyway, and then retire to the inner sanctum of the White House and break out the champagne.

The new law will not restrain healthcare costs as the government attempts to balance the disgrace of allowing the poor to suffer and die for want of healthcare in the wealthiest country on Earth against minimizing the costs to those who can afford to pay. And even though the new law will undoubtedly grandfather in a significant portion of those who have a stake in the current Social Security system as a payoff for their support, it will be only a matter of time before Social Security benefits will begin to fall—even for those who were bought off—as those not grandfathered in come to realize the unfairness of financing a welfare program through a payroll tax.

Since the new law will neither restrain healthcare costs nor provide government services at the level people desire, the government will continue to concentrate on cutting taxes, welfare, and government regulations. The special interests will continue to expand the government in ways that serve their ends; they will continue to cut whatever they can from those programs that serve the common good, and the federal debt will continue to grow.

In the meantime, our educational, transportation, public health, environmental, and social insurance systems will continue to decline as our criminal justice system continues to grow, and we will continue down the path we have followed over the past thirty years toward becoming the wealthiest third world nation on Earth. In the imaginary world of the propagandist, this will continued to be explained to the American people as being the inevitable result of the socialistic policies of liberals in spite of the fact that, in the real world, there hasn’t been a liberal president at the head of our government since Lyndon Johnson left office on January 20th, 1969; virtually all of the liberals were purged from Congress in the 1980s and 1990s, and liberals have been a relatively insignificant minority in our government ever since.

All of this will take place through a grand compromise in the imaginary world of the propagandists with all of the major players granted a seat at the table. The American people will be allowed to sit on the sidelines, never being told by those in charge what their real world alternatives actually are, and this will all make perfect sense in the imaginary world of the propagandists. And all you will have to do to figure it out on your own is listen to the propagandists—and don't think about it.

Bibliography

Endnotes

[1] The above is taken from the paper How Propaganda Works in which I have examined this piece of propaganda in detail.

[2] The way in which this propaganda is created by suppressing rational thought and playing on your prejudices, insecurities, and ignorance to generate fear, anger, and hatred toward the subject of the propaganda is examined in Some Notes on Right-wing Propaganda.

[3] The extent to which the American people have been bombarded with this propaganda, how it is funded, the ideological fallacies that underlie it, and why those who are responsible for this propaganda are dangerous are discussed in The Rise of Utopian Capitalism and the Crash of 2008. See also Why Blame Republicans?. An example of antigovernment propaganda is given in Congressional Reform Act of 2010.

[5] The way in which deregulation of our financial institutions led to the current economic crisis and how this crisis is related to the Crash of 1929 and the Great Depression that followed is explained in Where Did All the Money Go?.

[6] The Piketty and Saez data at http://elsa.berkeley.edu/~saez/TabFig2008.xls are examined in detail in Where Did All the Money Go? along with the epidemics of fraud referred to above.

[7] For a detailed discussion of the history of the federal budget that provides links to the official statistics published by the Office of Management and Budget see Understanding The Federal Budget.

[8] The nature of the Social Security funding problem and the need to raise taxes is explained Social Security, Healthcare, and Taxes.