Graphs from

Understanding the Federal Budget

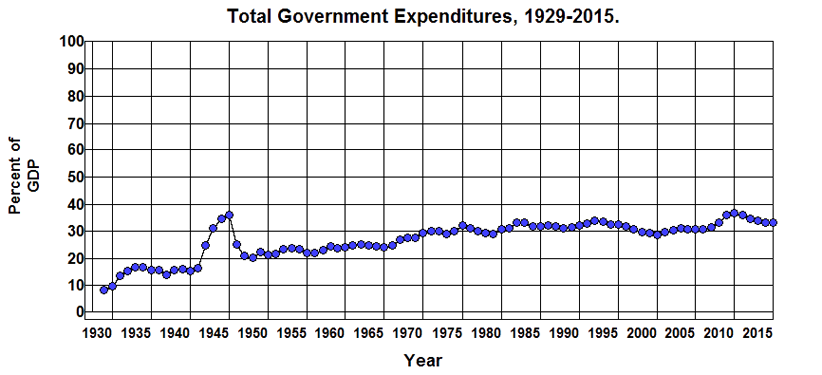

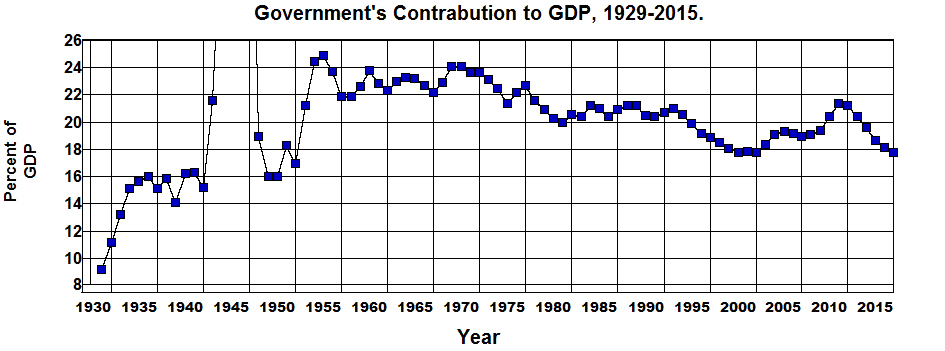

Source: Office of Management and Budget (1.1 10.1), Bureau of Economic Analysis. (1.1.5)

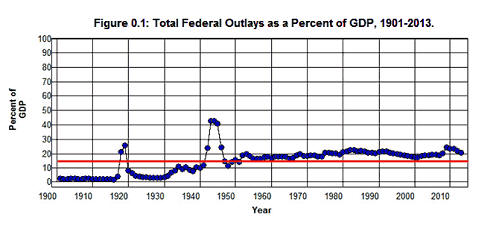

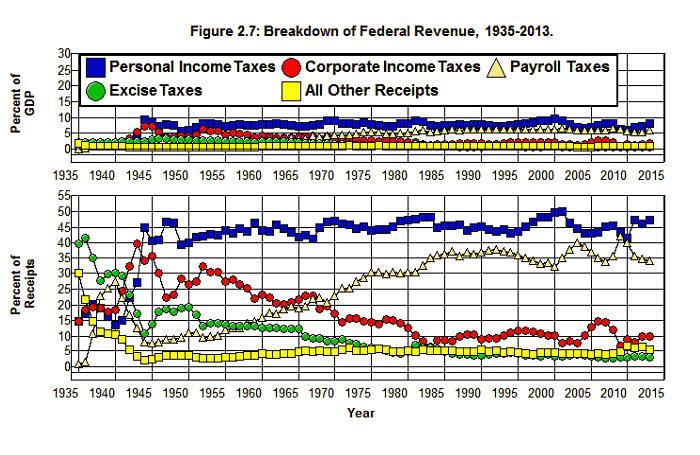

Source: Office of Management and Budget. (2.3 10.1)

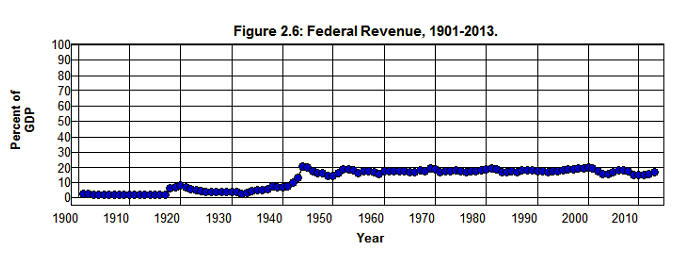

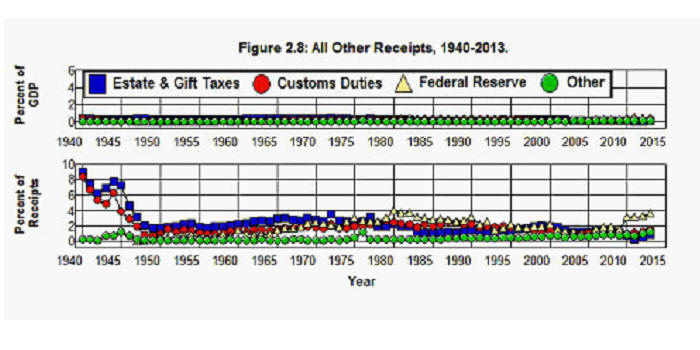

Source: Office of Management and Budget. (2.5 10.1)

Table 2.1: Breakdown of Federal Budget by Function and Subfunction, 2013.

Function and Subfunction, 2013

Billions of

DollarsPercent of

GDPPercent of

Budget050 National Defense:

$633.4

3.81%

18.33%

051 Department of Defense-Military:

$607.8

3.66%

17.59%

Military Personnel

$150.8

0.91%

4.37%

Operation and Maintenance

$259.7

1.56%

7.52%

Procurement

$114.9

0.69%

3.33%

Research, Development, Test, and Evaluation

$66.9

0.40%

1.94%

Military Construction

$12.3

0.07%

0.36%

Family Housing

$1.8

0.01%

0.05%

Other

$1.4

0.01%

0.04%

053 Atomic energy defense activities

$17.6

0.11%

0.51%

054 Defense-related activities:

$8.0

0.05%

0.23%

150 International Affairs:

$46.4

0.28%

1.34%

151 International development and humanitarian assistance

$22.8

0.14%

0.66%

152 International security assistance

$9.9

0.06%

0.29%

153 Conduct of foreign affairs

$13.0

0.08%

0.38%

154 Foreign information and exchange activities

$1.5

0.01%

0.04%

155 International financial programs

-$0.8

-0.01%

-0.02%

250 General Science, Space, and Technology:

$28.9

0.17%

0.84%

251 General science and basic research

$12.5

0.08%

0.36%

252 Space flight, research, and supporting activities

$16.4

0.10%

0.48%

270 Energy:

$11.0

0.00%

0.00%

271 Energy supply

$9.0

0.05%

0.26%

272 Energy conservation

$1.2

0.01%

0.04%

274 Emergency energy preparedness

$0.2

0.00%

0.01%

276 Energy information, policy, and regulation

$0.5

0.00%

0.02%

300 Natural Resources and Environment:

$38.1

0.23%

1.10%

301 Water resources

$7.7

0.05%

0.22%

302 Conservation and land management

$10.7

0.06%

0.31%

303 Recreational resources

$3.5

0.02%

0.10%

304 Pollution control and abatement

$9.6

0.06%

0.28%

306 Other natural resources

$6.6

0.04%

0.19%

350 Agriculture:

$29.5

0.18%

0.85%

351 Farm income stabilization

$25.0

0.15%

0.73%

352 Agricultural research and services

$4.4

0.03%

0.13%

370 Commerce and Housing Credit:

-$83.2

-0.50%

-2.41%

371 Mortgage credit

-$87.9

-0.53%

-2.54%

372 Postal service

-$1.8

-0.01%

-0.05%

373 Deposit insurance

$4.3

0.03%

0.12%

376 Other advancement of commerce

$2.2

0.01%

0.06%

400 Transportation:

$91.7

0.55%

2.65%

401 Ground transportation

$60.0

0.36%

1.74%

402 Air transportation

$21.5

0.13%

0.62%

403 Water transportation

$9.8

0.06%

0.28%

407 Other transportation

$0.4

0.00%

0.01%

450 Community and Regional Development:

$32.3

0.19%

0.94%

451 Community development

$7.8

0.05%

0.23%

452 Area and regional development

$1.5

0.01%

0.04%

453 Disaster relief and insurance

$23.0

0.14%

0.67%

500 Education, Training, Employment, and Social Services:

$72.8

0.44%

2.11%

501 Elementary, secondary, and vocational education

$42.4

0.26%

1.23%

502 Higher education

-$0.5

0.00%

-0.02%

503 Research and general education aids

$3.7

0.02%

0.11%

504 Training and employment

$7.3

0.04%

0.21%

505 Other labor services

$1.9

0.01%

0.05%

506 Social services

$18.1

0.11%

0.52%

550 Health:

$358.3

2.16%

10.37%

551 Health care services

$321.8

1.94%

9.32%

552 Health research and training

$32.9

0.20%

0.95%

554 Consumer and occupational health and safety

$3.6

0.02%

0.10%

570 Medicare:

$497.8

3.00%

14.41%

600 Income Security:

$536.5

3.23%

15.53%

601 General retirement and disability insurance (excluding social security)

$7.0

0.04%

0.20%

602 Federal employee retirement and disability

$131.7

0.79%

3.81%

603 Unemployment compensation

$70.7

0.43%

2.05%

604 Housing assistance

$46.7

0.28%

1.35%

605 Food and nutrition assistance

$109.7

0.66%

3.18%

609 Other income security

$170.7

1.03%

4.94%

650 Social Security:

$813.6

4.90%

23.55%

700 Veterans Benefits and Services:

$138.9

0.84%

4.02%

701 Income security for veterans

$65.9

0.40%

1.91%

702 Veterans education, training, and rehabilitation

$12.9

0.08%

0.37%

703 Hospital and medical care for veterans

$52.5

0.32%

1.52%

704 Veterans housing

$1.3

0.01%

0.04%

705 Other veterans benefits and services

$6.3

0.04%

0.18%

750 Administration of Justice:

$52.6

0.32%

1.52%

751 Federal law enforcement activities

$27.3

0.16%

0.79%

752 Federal litigative and judicial activities

$14.6

0.09%

0.42%

753 Federal correctional activities

$6.9

0.04%

0.20%

754 Criminal justice assistance

$3.8

0.02%

0.11%

800 General Government:

$27.8

0.17%

0.80%

801 Legislative functions

$3.7

0.02%

0.11%

802 Executive direction and management

$0.5

0.00%

0.01%

803 Central fiscal operations

$12.1

0.07%

0.35%

805 Central personnel management

$0.4

0.00%

0.01%

806 General purpose fiscal assistance

$7.9

0.05%

0.23%

808 Other general government

$6.0

0.04%

0.17%

809 Deductions for offsetting receipts

-$2.7

-0.02%

-0.08%

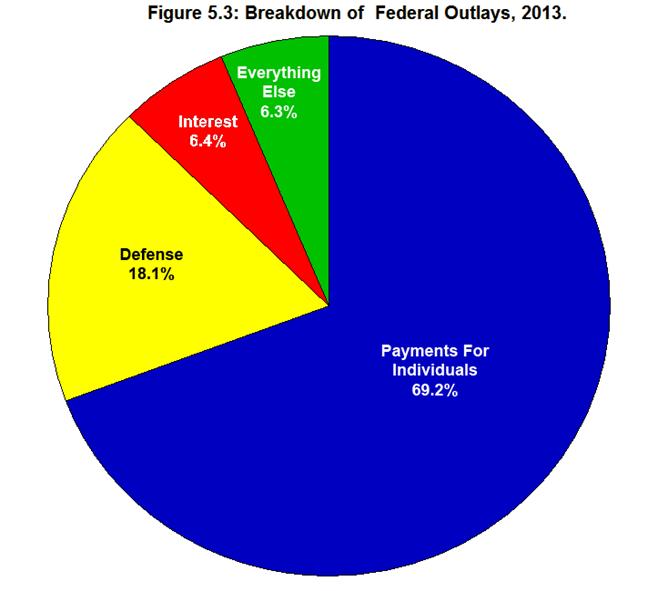

900 Net Interest:

$220.9

1.33%

6.39%

950 Undistributed Offsetting Receipts:

-$92.8

-0.56%

-2.69%

Total outlays

$3,454.6

20.79%

100.00%

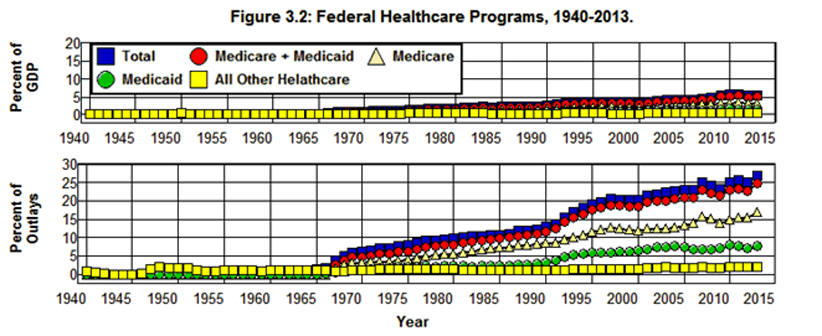

Source: Office of Management and Budget (3.2 10.1)

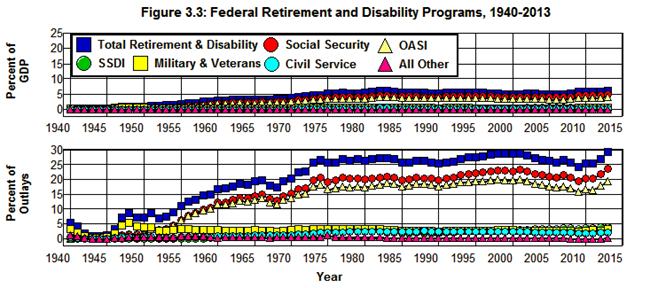

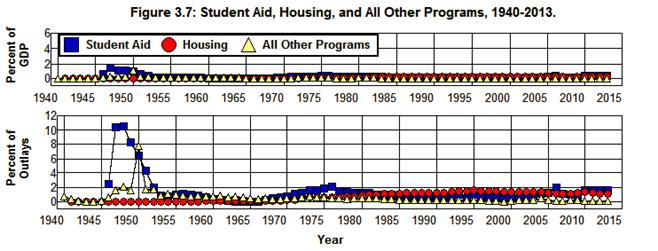

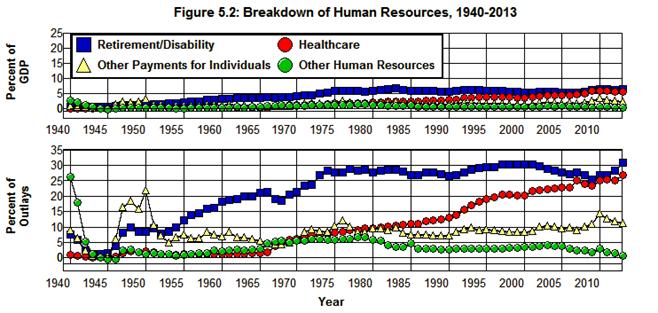

Source: Office of Management and Budget. (11.3 3.2 10.1)

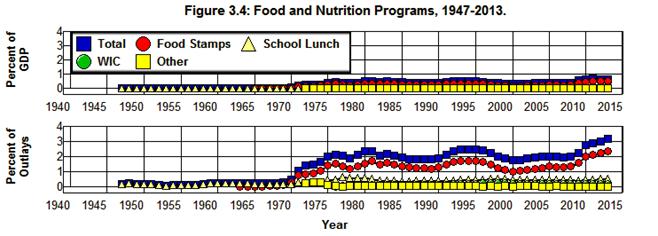

Source: Office of Management and Budget. (11.3 3.2 10.1)

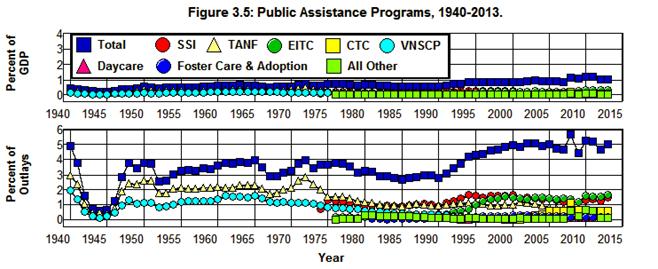

Source: Office of Management and Budget. (11.3 3.2 10.1)

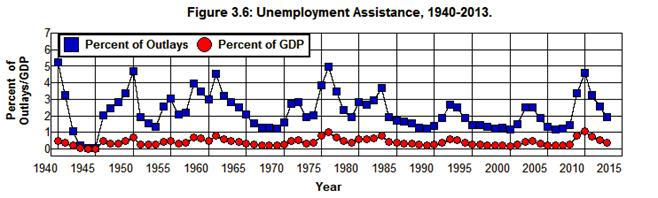

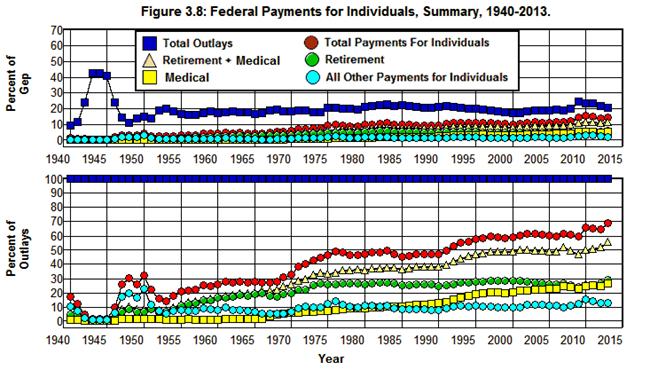

Source: Office of Management and Budget. (11.3 3.2 10.1)

Source: Office of Management and Budget. (11.3 3.2 10.1)

Source: Office of Management and Budget. (11.3 3.2 10.1)

Source: Office of Management and Budget. (11.3 3.2 10.1)

Source: Office of Management and Budget. (11.3 3.2 10.1)

Table 4.1: Federal Welfare Programs and Expenditures, 2013.

Program (2013)

Billions of

DollarsPercent of

GDPPercent of

Budget$282.4

1.70%

8.17%

$9.5

0.06%

0.27%

$265.4

1.60%

7.68%

$4.3

0.03%

0.12%

$3.2

0.02%

0.09%

$44.9

0.27%

1.30%

$39.3

0.24%

1.14%

$109.6

0.66%

3.17%

$82.5

0.50%

2.39%

$19.3

0.12%

0.56%

$6.6

0.04%

0.19%

$1.1

0.01%

0.03%

$172.5

1.04%

4.99%

$50.3

0.30%

1.46%

$21.2

0.13%

0.61%

$3.5

0.02%

0.10%

$57.5

0.35%

1.66%

$5.0

0.03%

0.15%

$5.2

0.03%

0.15%

$6.8

0.04%

0.20%

$21.6

0.13%

0.63%

$0.2

0.00%

0.00%

$1.2

0.01%

0.04%

$648.6

3.90%

18.78%

Source: Office of Management and Budget. (11.3 10.1)

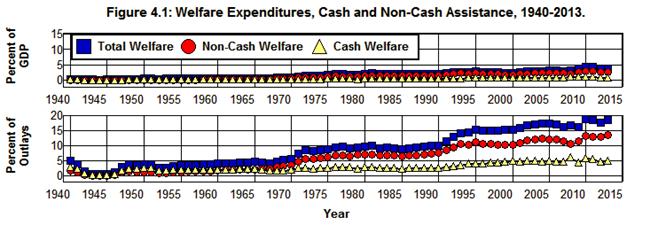

Source: Office of Management and Budget. (11.3 3.2 10.1)

Source: Office of Management and Budget. (11.3 3.2 10.1)

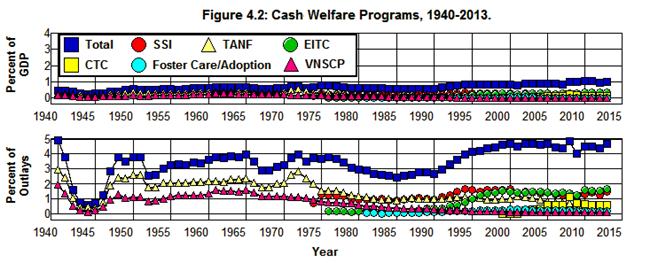

Source: Office of Management and Budget. (11.3 3.2 10.1)

Source: Office of Management and Budget. (11.3 3.2 10.1)

Source: Census Bureau (151)

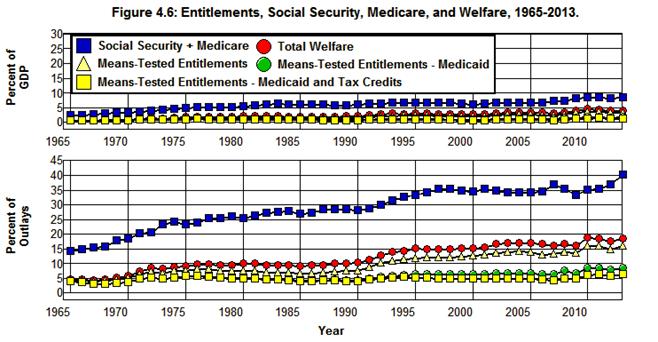

Source: Office of Management and Budget. (8.1 10.1 11.3)

Source: Office of Management and Budget. (8.1 11.3 10.1)

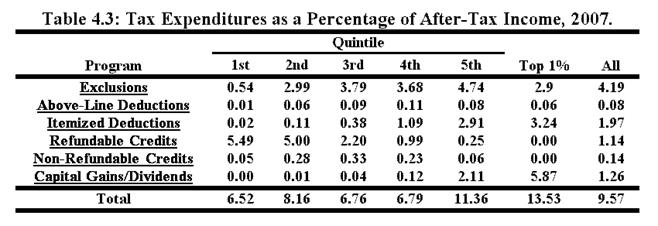

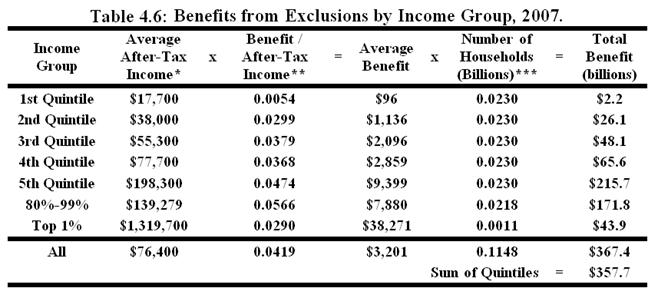

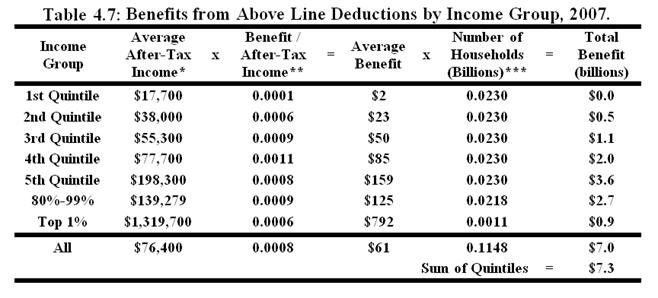

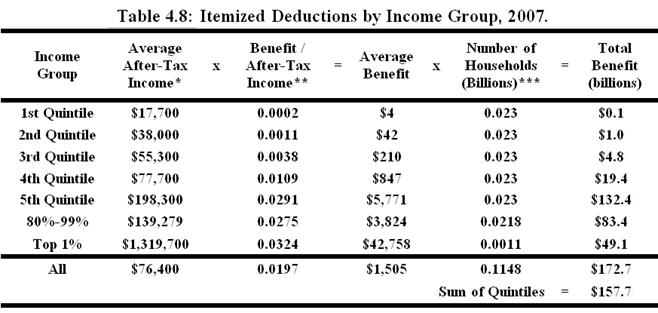

Source: Burman, Toder, and Geissler.

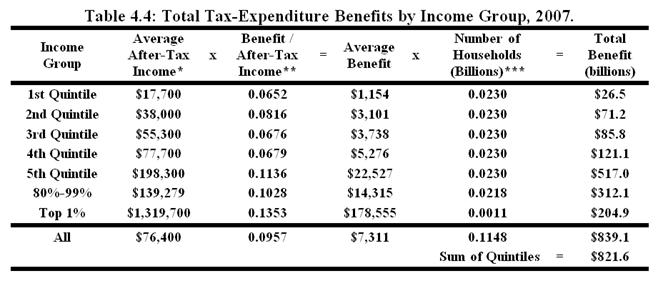

Source: *Congressional Budget Office, **Burman et al., ***Census Bureau.

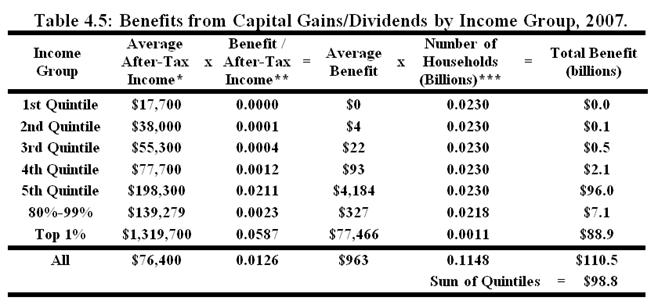

Source: *Congressional Budget Office, **Burman et al., ***Census Bureau.

Source: *Congressional Budget Office, **Burman et al., ***Census Bureau.

Source: *Congressional Budget Office, **Burman et al., ***Census Bureau.

Source: *Congressional Budget Office, **Burman et al., ***Census Bureau.

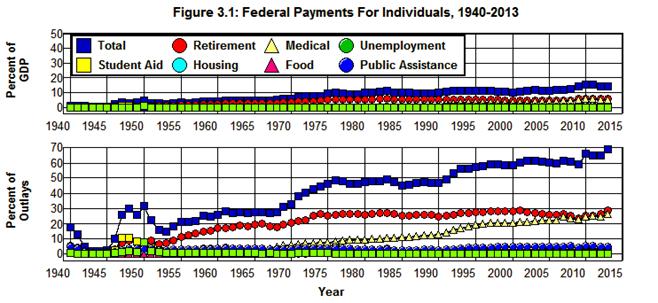

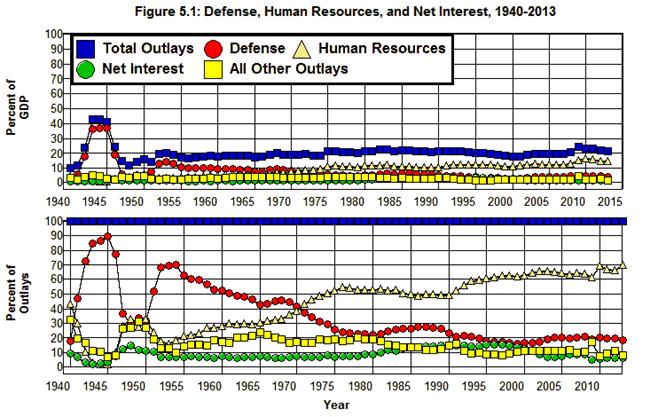

Source: Office of Management and Budget. (3.1 10.1)

Source: Office of Management and Budget. (11.3 3.1 10.1)

Table 5.1: Expenditures Included in Retirement/Disability, 2013.

Program (2013)

Billions of

DollarsPercent of

GDPPercent of

OutlaysSocial security and railroad retirement: $814.5

4.90%

23.58%

Social security: old age and survivors insurance $667.2

4.01%

19.31%

Social security: disability insurance $140.1

0.84%

4.06%

Railroad retirement (excl. social security) $7.2

0.04%

0.21%

Federal employees retirement and insurance: $194.0

1.17%

5.62%

Military retirement $54.3

0.33%

1.57%

Civil service retirement $77.2

0.46%

2.23%

Veterans service-connected compensation $59.4

0.36%

1.72%

Other $3.2

0.02%

0.09%

Public assistance and related programs: $55.5

0.33%

1.61%

Supplemental security income program $50.3

0.30%

1.46%

Veterans non-service connected pensions $5.2

0.03%

0.15%

Total: Retirement/ Disability

$1,064.0

6.40%

30.80%

Source: Office of Management and Budget. (11.3 3.1 10.1)

Table 5.2: Expenditures Included in Healthcare, 2013.

Program 2013

Billions of

DollarsPercent of

GDPPercent of

Budget$583.8

3.51%

16.90%

$273.0

1.64%

7.90%

$310.8

1.87%

9.00%

$265.4

1.60%

7.68%

$9.5

0.06%

0.27%

$51.8

0.31%

1.50%

$43.6

0.26%

1.26%

$8.2

0.05%

0.24%

$15.6

0.09%

0.45%

$4.3

0.03%

0.12%

$7.3

0.04%

0.21%

$3.2

0.02%

0.09%

$0.8

0.00%

0.02%

Total: Medical care

$926.1

5.57%

26.81%

Source: Office of Management and Budget. (11.3 3.1 10.1)

Table 5.3: Non-Medical and Non-Retirement/Disability Programs, 2013.

Program 2013

Billions of

DollarsPercent of

GDPPercent of

Budget68.3

0.41%

1.98%

58.0

0.35%

1.68%

13.2

0.08%

0.38%

44.9

0.27%

1.30%

39.3

0.24%

1.14%

109.6

0.66%

3.17%

82.5

0.50%

2.39%

19.3

0.12%

0.56%

6.6

0.04%

0.19%

1.1

0.01%

0.03%

116.9

0.70%

3.38%

21.2

0.13%

0.61%

3.5

0.02%

0.10%

57.5

0.35%

1.66%

5.0

0.03%

0.15%

6.8

0.04%

0.20%

21.6

0.13%

0.63%

1.2

0.01%

0.04%

6.1

0.04%

0.18%

0.4

0.00%

0.01%

1.2

0.01%

0.04%

1.4

0.01%

0.04%

1.2

0.01%

0.04%

1.8

0.01%

0.05%

Total: Non- Medical/ Retirement/ Disability Programs

398.2

2.40%

11.53%

Source: Office of Management and Budget. (11.3 3.1 10.1)

Table 5.4: Ten Largest Items in Other Payments for Individuals, 2013.

Program 2013

Billions of

DollarsPercent of

GDPPercent of

Budget$82.5

0.50%

2.39%

Unemployment Assistance $68.3

0.41%

1.98%

$57.5

0.35%

1.66%

$44.9

0.27%

1.30%

$39.3

0.24%

1.14%

$21.6

0.13%

0.63%

$21.2

0.13%

0.61%

$19.3

0.12%

0.56%

$13.2

0.08%

0.38%

$6.8

0.04%

0.20%

Total: 10 Largest in Other Payments for Individuals

$374.6

2.25%

10.84%

Source: Office of Management and Budget’s (11.3 3.2 10.1)

See Also:

How a Conservative Would Balance the Federal Budget

Lower Taxes, less Government, and Deregulation

A Note on Tax-Expenditure Entitlements and Welfare

Budget Projections, Federal Debt, Social Security, and Medicare