The Simpson-Bowles Solution to the Deficit Problem

George H. Blackford © 2011

The bipartisan Moment of Truth report written by Alan Simpson and Erskine Bowles is the end product of the President’s National Commission on Fiscal Responsibility and Reform. This report puts forth a set of recommendations that purport to deal with the federal deficit and debt problems in a comprehensive way. Of particular interest in this report are the recommendations regarding Social Security, Medicare, and revisions of the tax code.

Social Security

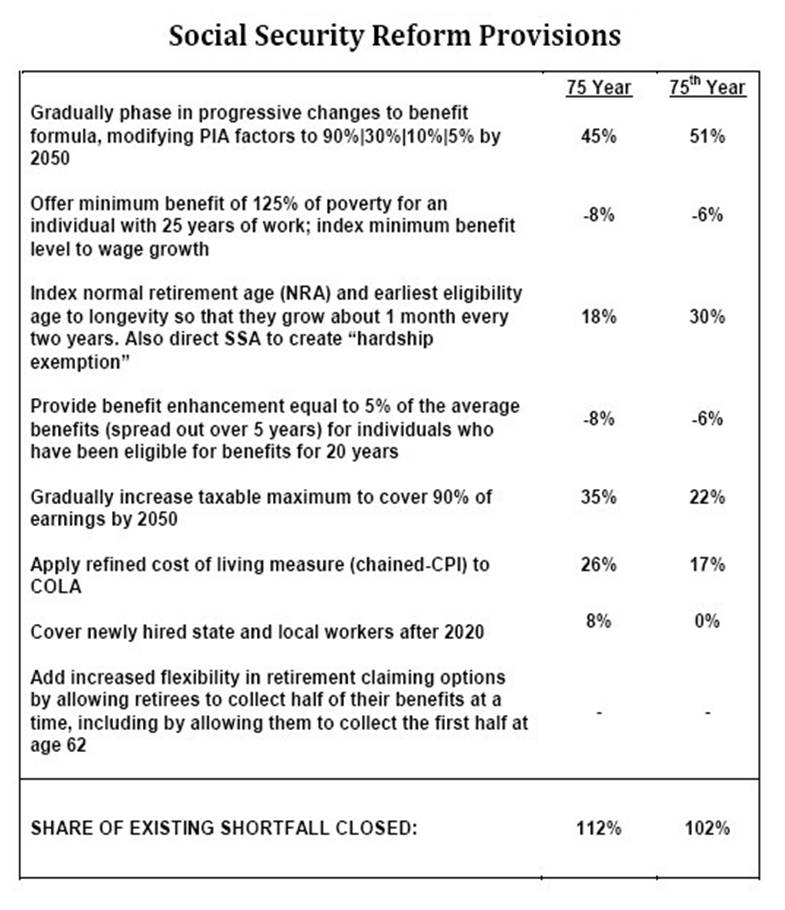

Concerning Social Security, the Simpson-Bowles recommendations are summarized in Figure 1. They contain five key elements:

Gradually phase in progressive changes to the benefit formula while increasing the minimum benefit and adding a longevity benefit. (29%)

Index retirement age and earliest eligibility age to increase with longevity. (18%)

Use a chained CPI rather than the standard CPI to adjust benefits for changes in the cost of living. (26%)

Gradually increase the income cap to cover 90% of wage income. (35%)

Add newly hired state and local government employees to the program after 2020. (8%)

The percentage in parentheses following each item indicates its contribution toward eliminating the expected shortfall in Social Security funding over the next seventy-five years.

Figure 1: Summary of Social Security Reform from Moment Of Truth Report

Source: Moment of Truth Report.

The first element combines the first, second, and forth items in Figure 1 where the savings are supposed to be achieved by making the benefit payout system more progressive—that is, by lowering the benefits paid to high income recipients while, at the same time, increasing the benefits paid to low income recipients. This suggestion is rather disingenuous, however, in that the savings come from a net cut in benefits to the higher wage earners, not from the fact that the resulting payout scheme is more progressive. If the increase in benefits paid to low wage earners were equal to the decrease in benefits paid to higher wage earners there would be no savings from this adjustment in progressivity.

The second item obviously achieves the savings, without any pretext, through a straightforward across the board cut in benefits by increasing the retirement age. The third also achieves the savings by cutting benefits by way of a controversial change in the way the Social Security cost of living adjustment is calculated. (WSJ SGS) The last two achieve their savings by increasing the payroll tax base.

Thus, when we do the math, we find that these recommendations solve Social Security’s future revenue problem by cutting benefits to cover 73% of the expected shortfall and by expanding the tax base to cover an additional 43% of the shortfall. (Presumably, the redundant 16% of savings is there to maintain the Social Security trust fund that will be lent to the government.) According to Simpson and Bowles, if we accept their recommendations Social Security will be on a sound financial footing for the next 75 years.

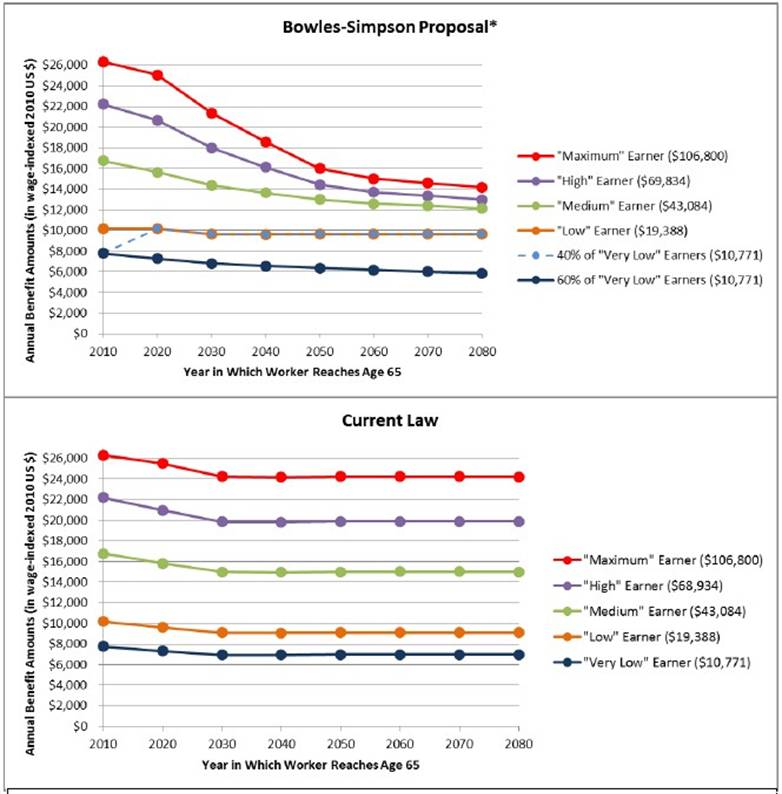

It is worth noting, however, that if these recommendations are implemented they will have the effect of converting Social Security from an insurance program in which the vast majority of the participants benefit, into a welfare program for the elderly in which mostly the poor benefit, and those who pay most of the payroll taxes get much less out of the program than they pay in. The extent to which this is so is indicated in Figure 2 which shows the expected payout under the current law and how the payout structure would change under the Simpson-Bowles recommendations. This is not Social Security as we know it.

Even worse, the Simpson-Bowles scheme proposes to fund this welfare program through the payroll tax. The payroll tax is one of the most regressive taxes there is. It is levied only on earned income (income received from wages and salaries) with no deductions and only minor exemptions, and the total amount of earned income taxed is capped where today's cap is $106,800. It is not levied on unearned income (income received in the form of interest, dividends, capital gains, rent, and corporate profits) or on earned income above the $106,800 cap. As a result, virtually all of the income of low income families is subject to the Social Security tax since virtually all of their income comes from wages and salaries, while virtually none of the income of the wealthy is subject to this tax since virtually all of their income is either above the cap on earned income or comes from unearned income.

Figure 2: Social Security Payout Structure.

Source: www.StrengthenSocialSecurity.org Benefits Chart.

The payroll tax is hardly an equitable way to finance a welfare program. The burden of financing a welfare program should fall heaviest on those who can afford to pay, not on the backs of the working poor as is the case when the payroll tax is used. It makes sense to use a payroll tax to finance an insurance program; it does not make sense to use a payroll tax to finance a welfare program.

Healthcare

In dealing with healthcare, the main thrust of the Simpson’s-Bowles recommendations is to reduce healthcare costs by forcing healthcare recipients, both public and private, to pay a larger proportion of the cost. But this plan can only reduce costs to the extent it forces those who cannot afford the added costs out of the healthcare system since to the extent the government picks up the tab for those who cannot afford the added cost there is no saving.

This begs the question: How many of those who cannot afford to pay the added costs should be allowed to die for want of healthcare in order to minimize the cost of healthcare for those who can afford to pay? It is the ultimate death panel plan whereby those who cannot afford the added costs are allowed to die. The only alternative is for government to pick up the tab for those who cannot afford to pay which will inevitably increase the cost of healthcare for the government as more and more people are unable to pay and forced out of the private system.

As with the Simpson-Bowles recommendations for Social Security, the end result is not Medicare as we know it.

Reforming the Tax Code

What is particularly disturbing about the Simpson-Bowles bipartisan plan for deficit reduction, however, is that while they recommend massive cuts in Social Security and Medicare benefits, at the same time they recommend the top marginal income tax rate paid by corporations and the wealthy be cut from 35% to 28%, that the marginal income tax rate paid by middle-income earners be set at 22%, and that the lowest income tax rate paid by the not so wealthy be increased from 10% to 12%.

It these changes are passed into law, the combined 15.3% employee/employer payroll tax rate plus the income tax rate in the lowest income bracket will equal 27.3%—less than one percentage point below the 28% marginal rate corporations and multibillionaires will pay. Those in lower end of the middle tax bracket will face a combined marginal rate of 37.3%—9.3 percentage points above the marginal rate multibillionaires and corporations will pay. Even though Simpson and Bowles also recommend treating dividends and capital gains as ordinary income and recommend a few other changes that will make the tax code somewhat more progressive, there is something very wrong here.

Conclusion

There was a surplus in the federal budget equal to 2.4% of GDP in 2000 before the massive 2001-2003 Bush tax cuts, before the invasion of Iraq, and before those who ran our financial institutions devastated our economy by selling securities backed by fraudulently obtained subprime mortgages all over the world. The fiscal problems we face today are clearly the result of the Bush cut taxes combined with the increases in defense expenditures squandered in Iraq and the devastating recession brought on by the fraudulent, reckless, and irresponsible behavior of our financial institutions. Social Security and Medicare had nothing to do with this.

And now—in the name of fiscal responsibility—we are supposed 1) cut Medicare benefits and increase the private cost of healthcare dramatically, 2) convert Social Security into a welfare program paid for with payroll taxes in order to avoid paying an increase in benefits equal to 2% of GDP, and, at the same time, 3) give additional tax cuts to those at the top of the income distribution, many of whom made fortunes out of the Iraq war and as they perpetrated the greatest fraud in history in the process of devastating our economy? And to add insult to injury, we are also supposed to increase the taxes paid by those in the lowest income tax bracket? This not only defies common sense, it defies common decency.

The federal deficit is the problem, and the Simpson-Bowles report does not deal with this problem in a substantive way. There is no discussion as to how optimum level or quality healthcare can be provided to the population in the most cost effective way in their report. No discussion as to how Social Security and Medicare can be maintained as viable insurance programs. No discussion as to how the optimum level of essential government services can be made available in their most cost effective manner. This report concentrates only on cutting government services and lowering tax rates paid by the upper-income groups. This is just more of what we have been doing for the past 30 years, and it simply hasn’t worked. Why would anyone expect it to start working now? [1]

It does serve the ends of those who just want their taxes cut and who have the wherewithal to lobby their special interests through Congress—those who don’t care about the national debt or government programs that provide for the common good so long as they get what they want out of the government and don’t have to pay taxes— but it does not serve the ends of the vast majority of the American people who want better public education, better healthcare and public health, better and safer streets, a cleaner and safer environment, protection from predators who would fraudulently take advantage of them, safe food and drugs and consumer products, safe working conditions, social-insurance programs such as Medicare and Social Security, and a stable economy that is not plagued by cycles of booms and busts brought on by epidemics of fraud in our financial system that drive our country and people deeper and deeper into debt and lead to the kind of economic catastrophe we are in the midst of today.

These are all things that good government provides, and concentrating on cutting government services and lowering the tax rates paid by the upper-income groups in our society does not provide good government. It does not lead to a government that promotes the common good and creates economic prosperity. It leads to a government that promotes the special interests and leads to economic disaster.[2] This should be obvious to anyone who has paid attention to what has been going on in our country for the past 30 years. Doing the same thing over and over again and expecting a different result is not the way to solve the deficit problem and provide good government.

The only way to solve the deficit problem is to provide the government services that the people demand, and then collect the taxes necessary to pay for those services. This isn’t very complicated, and it could be done quite easily by

rescinding the 1981 tax cuts—except for the lowest two brackets to compensate for the way in which the taxes of those in these brackets have increased over the past 30 years—while at the same time changing the tax code to treat capital gains and dividends as ordinary income,

using the proceeds to mitigate the effects of the recession on the deficit and to put people to work rebuilding the public infrastructure we have allowed to decline over the past thirty years—that is to say that we must increase government expenditures,

controlling defense expenditures in a responsible way,

eliminating unwarranted tax deductions and credits, and

dealing with our escalating healthcare costs by either extending Medicare to the rest of the population or, at the very least, by adding a public option to the Patient Protection and Affordable Care Act. It will, of course, also be necessary to reregulate our financial institutions to keep them from creating in the future the kind of mess they have created throughout history when unrestrained by government regulation, the kind of mess that has brought us to where we are today.

Rescinding the Bush tax cuts and treating capital gains and dividends as ordinary income would give us a tax structure comparable to that which yielded a surplus equal to 2.4% of GDP in 2000 when the economy was near full employment. It would not necessarily give us a surplus today, but it would at least give us a tax structure that is viable—one that would make it possible to pay down the national debt when we recover from the current recession. It would also make it possible to pay for the government services the people demand, such as Social Security and Medicare, without having to destroy these programs.

Extending Medicare to the rest of the population would make it possible to control healthcare costs while at the same time providing quality healthcare to the entire population. We spend more per person and as a percent of GDP than any other country that has better health statistics than we do. At the same time, we rank 51th in terms of life expectancy, 51st in terms of infant mortality, 24th in terms of the availability of doctors, and 37th in terms of the overall performance of our healthcare system.

Our multiple third-party payment system, whereby providers decide what services patients need and how much to charge while insurance companies or the government pick up the tab virtually guarantees continually deteriorating quality and increasing costs since there is no incentive in this system to deliver quality healthcare services in a cost effective manner. It also virtually guarantees that either our health statistics will deteriorate or a continually increasing share of the healthcare costs will be passed on to the government as these costs rise and fewer and fewer people are able to afford these rising costs.

Every advanced country in the world that has better health statistics and lower healthcare costs has abandoned the cost ineffective multiple third-party payer system for a single-payer, universal healthcare system that provides government subsidized healthcare for all—paid for through taxes—where costs are controlled through government negotiated prices. They pay higher taxes than we do, but their higher taxes are more than offset by the savings in insurance premiums and lower healthcare costs—not to mention the fact that they are healthier than we are, and they live longer than we do.

The simplest, most efficient, and most cost effective way to provide a comparable system for the United States would be to extend the Medicare program to the entire population. This program works, and the institutions necessary to run it are already in place. It would take very little effort to retool Medicare to meet the needs of the entire population compared to the massive and wasted effort it is going to take to implement the Patient Protection and Affordable Care Act.

And there are many ways to deal with the Social Security problem within the above framework that do not entail converting Social Security into a welfare program. One would be to

Increase the payroll cap to apply to 90% of covered earnings as Congress intended back in 1977 or, perhaps, to an even higher percentage.

Convert the federal estate tax to a dedicated Social Security tax that is credited automatically to the Social Security trust fund.

Expand the program to cover newly hired state and local workers.

Implement modest changes in payroll taxes and Social Security benefits if needed after the above changes have been made and, perhaps, extend the payroll tax to include unearned income.

Approaching the expected Social Security deficit problem in this way would not require the draconian cuts in benefits put forth in the Moment of Truth Report nor would it require draconian payroll tax increases. I suspect the vast majority of the American people would support this approach if given the choice. Instead, they are given the false choice between 1) accepting a solution that will convert Social Security into a welfare program and increase the private cost of healthcare—a policy that will not reduce costs unless we deny healthcare to those who cannot afford to pay—or 2) letting the deficit and national debt grow without restraint until the system collapses. This is a false choice, and it should be recognized as such.

The real choice facing the American people today is weather to 1) increase taxes and reorganize our healthcare system and thereby maintain Social Security and Medicare or 2) not increase taxes and cut Social Security and Medicare along with other essential government services. The only other option is to continue to increase the national debt until the burden becomes unbearable.

For a more in depth examination of the issues raised by the Moment of Truth report written by Alan Simpson and Erskine Bowles see Social Security, Healthcare, and Taxes,Where Did All the Money Go?, and Understanding The Federal Budget. For an explanation of why we are faced with the false choice put forth by Simpson and Bowles, see It Makes Sense if You Don't Think About It.

Endnotes

[1] See Where Did All the Money Go? and Understanding The Federal Budget.

[2] See Where Did All the Money Go? and It Makes Sense if You Don't Think About It.